Project Finance

Contents

- 1 Introduction

- 2 Parties to a Project Financing

- 3 Project Financing Documentation

- 4 Project Structures

- 5 Sharing of Risks

- 6 Security For Projects

- 7 Insurance Issues

- 8 The Project Loan Agreement

- 9 Export Credit Agencies And Multilateral Agencies

- 9.1 The role of export credit agencies in project finance

- 9.2 An introduction to the G7 ECAs

- 9.3 The advantages of involving ECAs in a project

- 9.4 The OECD consensus

- 9.5 Departing from consensus

- 9.6 Categories of ECA support in the context of a project financing

- 9.7 The changing role of the ECA in project finance

- 9.8 ECAs and credit documentation

- 9.9 Multilateral Agencies

- 9.10 World Bank Group

- 9.11 European Bank for Reconstruction and Development (EBRD)

- 9.12 European Investment Bank (EIB)

- 9.13 Asian Development Bank (ADB)

- 9.14 Commonwealth Development Corporation Group Plc (CDC Group Plc)

- 9.15 Intercreditor Issues in Multi-Source Project Finance

Introduction

Origins of project financing

With the explosion of project financing in the late 1980s and 1990s, both in Europe and around the rest of the world, there is a temptation to think that the financing of projects on limited or non-recourse terms is a relatively novel concept, and one for which the ingenious lawyers and bankers of the 1980s can take most of the credit. This is, however, far from being true. Indeed, there is early evidence of project financing techniques being actively used during Roman times and earlier still. According to the historians, sea voyages on the Mediterranean ocean were extremely dangerous adventures in Greek and Roman times, mostly on account of the dual perils of storms and pirates. As a result of these nautical perils, some risk averse merchants would take out a fenus nauticum (sea loan) with a local lender in order to share with that lender the risk of a particular voyage. The fenus nauticum worked on the basis that the loan was advanced to the merchant for the purpose of purchasing goods on the outward voyage, which loan would be repayable out of the proceeds of the sale of these goods (or more likely other goods bought overseas with these proceeds). If the ship did not arrive safely at the home port with the cargo in question on board, then according to the terms of the fenus nauticum, the loan was not repayable. At the time, this was viewed essentially as a form of marine insurance, but it can just as easily be classified as an early form of limited recourse lending, with the lender assuming the risk of the high seas and the perils that accompanied her. History also recounts that, in order to protect their interests, these brave lenders would often send one of their slaves on the voyage to ensure that the merchant was not tempted to cheat on the lender (an early ancestor of the security trustee perhaps!).

In modern times too there is plenty of evidence of project financing techniques being used by lenders to finance projects around the world. In the 19th century, lenders in the City of London were financing numerous railway and other projects in South America and India and investing in other overseas ventures that had many features of modern-day limited recourse lending. In most cases these loans were not specifically structured as limited recourse loans as we know them today, but the commercial reality was that this is exactly what they were.

However, limited recourse lending in the UK really took off in the early 1970s when lenders in the UK started making project finance available for the development of some of the early oil and gas fields in the UK continental shelf. The early projects that were financed on this basis were relatively few and far between as there was a relatively small pool of lenders prepared to finance projects on this basis. It would also be true to say that the treasurers of many of the companies operating in the UK continental shelf at this time took some time to appreciate the advantages of financing projects in this way. The first major financing in the North Sea was in the early 1970s. This was British Petroleum’s Forties Field, which raised about £1 billion by way of a forward purchase agreement (see section 4.7 for a description of this structure). Shortly after this transaction two loans were raised by licence holders in the Piper Field (Occidental Petroleum Corporation and the International Thompson Organisation). Other financings of North Sea hydrocarbon assets followed and by the late 1970s and early 1980s what had started as a modest number of transactions had turned into a significant volume of project financings related to oil and gas fields, first in the UK continental shelf and then in the Danish and Norwegian continental shelves.

Much of the documentation and many of the techniques for these early oil and gas transactions were borrowed from practice in the US where adventurous bankers had been lending against oil and gas assets for many years. The significant difference in the context of the North Sea, however, was that bankers were in reality taking significantly more risks in lending against oil and gas assets in the North Sea. Not only were these brave bankers lending against offshore oil and gas assets where the risks were considerably greater (especially in the early days, given the new technology being developed and utilised), but they were also, in some cases, assuming all or part of the development/completion risk. Traditionally, in the early days of project financing in the US, loans were agreed against producing onshore assets, which carried a far lesser degree of risk. The North Sea was, however, an altogether more hostile and hazardous environment.

The 1980s in the UK saw perhaps the greatest growth spurt in project financing, with power projects, infrastructure projects, transportation projects and, at the end of that decade, telecommunications projects leading the way. This was continued throughout the 1990s until the more recent global financial crisis, which saw a huge growth in project financing, not only in Europe and the US but also throughout Southeast Asia and further afield.

Definition of project finance

There is no universally accepted definition of project finance. A typical definition of project financing might be: “The financing of the development or exploitation of a right, natural resource or other asset where the bulk of the financing is to be provided by way of debt and is to be repaid principally out of the assets being financed and their revenues.”

Other more sophisticated definitions are used for special purposes; set out at the table below. 1 is an example of a definition used in a corporate bond issue. This illustrates the aims of the bondholders, on the one hand, to exclude from the definition any borrowings having a recourse element (since the purpose of the definition was to exclude project finance borrowings from the bond’s cross-default and negative pledge) whilst, on the other hand, the aim of the issuer to catch as wide a range of project-related borrowings.

Definition of Project Finance Borrowing

“Project Finance Borrowing” means any borrowing to finance a project:

- (a) which is made by a single purpose company whose principal assets and business are constituted by that project

and whose liabilities in respect of the borrowing concerned are not directly or indirectly the subject of a guarantee, indemnity or any other form of assurance, undertaking or support from any member of the [Group] except as expressly referred to in paragraph (b)(iii) below

- (b) in respect of which the person or persons making such borrowing available to the relevant borrower have no

recourse whatsoever to any member of the [Group] for the repayment of or payment of any sum relating to such borrowing other than:

- (i) recourse to the borrower for amounts limited to aggregate cash flow or net cash flow from such project

and/or

- (ii) recourse to the borrower for the purpose only of enabling amounts to be claimed in respect of that

borrowing in an enforcement of any security interest given by the borrower over the assets comprised in the project (or given by any shareholder in the borrower over its shares in the borrower) to secure that borrowing or any recourse referred to in (iii) below, provided that (A) the extent of such recourse to the borrower is limited solely to the amount of any recoveries made on any such enforcement, and (B) such person or persons are not entitled, by virtue of any right or claim arising out of or in connection with such borrowing, to commence proceedings for the winding-up or dissolution of the borrower or to appoint or procure the appointment of any receiver, trustee or similar person or official in respect of the borrower or any of its assets (save for the assets of the subject of such security interest) and/or

- (iii) recourse to such borrower generally, or directly or indirectly to a member of the [Group] under any form of

completion guarantee, assurance or undertaking, which recourse is limited to a claim for damages (other than liquidated damages and damages required to be calculated in a specified way) for breach of any obligation (not being a payment obligation or any obligation to procure payment by another or an obligation to comply or to procure compliance by another with any financial ratios or other tests of financial condition) by the person against whom such recourse is available or

- (c) which the lender shall have agreed in writing to treat as a project finance borrowing.

The overriding aim behind this rather complex definition is to make it clear that the repayment of the loan in question is, essentially, limited to the assets of the project being financed. It should be noted that this Guide does not cover either ship or aircraft financing, although many financings of ships and aircraft are financed on limited recourse terms and could be said to project financings. In many of these cases the lenders will, directly or indirectly, limit their recourse to the vessel or aircraft itself, its earnings(including requisition compensation) and its insurances. However, the financing of ships and aircraft is a specialised area and is not within the scope of this Guide. Many of the provisions of this section will, however, apply equally to the financing of ships and aircraft.

Extent of recourse

The expressions “non-recourse finance” and “limited recourse finance” are often used interchangeably with the term “project finance”. In strict terms, non-recourse finance is extremely rare and in most project finance transactions there is some (limited) recourse back to the borrower/sponsor beyond the assets that are being financed. As will be seen in section 6, this security may amount to full or partial completion guarantees, undertakings to cover cost overruns or other degrees of support (or comfort) made available by the sponsors/shareholders or others to the lenders.

It may even be that the only tangible form of support that a lender receives over and above the project assets is a right to rescind the project loan agreement with the borrower and/or to claim damages for breach of any undertakings, representations or warranties given by the borrower in the project loan agreement. Of course, where the borrower is a special purpose vehicle with no assets other than the project assets being financed by the lenders, then a right to claim damages from the borrower is likely to add little to a claim by the lenders for recovery of the project loan from the borrower. Further, the right to rescind the project loan agreement is likely merely to duplicate the acceleration rights of the lenders following the occurrence of an event of default contained in the project loan agreement. However, in those cases where the borrower does have other assets, or the sponsors are prepared to underwrite any claims by the project lenders for damages against the borrower, then a claim for damages for breach of any undertakings, representations or warranties may afford the lenders some additional recourse.

A claim for damages, however, from a lender’s perspective is not the same under English law (and for that matter most common law based jurisdictions) as a claim for recovery of a debt under, say, a financial guarantee. This is because a claim for damages is subject to certain common law rules; for example:

- The lender must show that the loss was caused by the breach in question

- This loss must have been reasonably foreseeable at the time the undertaking or warranty was given

- The lender is in any event under a duty to mitigate its loss.

In other words, a claim for damages against the borrower is an unliquidated claim as opposed to a claim for a debt, which would be a liquidated claim. All that a lender has to show in the case of a liquidated claim is that the debt was incurred or assumed by the borrower and that it has become due. This is clearly considerably easier than having to satisfy the common law rules and, consequently, lenders and their advisers, wherever possible, will seek to structure arrangements with a view to acquiring liquidated claims against borrowers and others supporting the borrower’s obligations (this is particularly important for lenders in the context of sponsor completion undertakings – see section 6.5).

One of the key differences, therefore, between project financing and corporate financing lies in the recourse that the lender has to the assets of the borrower. As the earlier definitions demonstrate, in project financing this recourse is limited to an identifiable pool of assets, whereas in corporate financing the lender will have recourse to all the assets of the borrower (to the extent that these assets have not been charged to other lenders). Indeed, should the borrower fail to pay a debt when due, then, subject to the terms of the loan documentation, the lender would be entitled to petition to wind up the borrower and prove in the liquidation of the borrower on a pari passu basis with all the other unsecured creditors of the borrower. In the context of a project financing, however, a lender would only be entitled to this ultimate sanction if the project vehicle is a special purpose vehicle set up specially for the project being financed. In those cases where the project vehicle undertook other activities, then it would look to ring fence the assets associated with these activities and in these cases the lender would not ordinarily be entitled to petition to wind up the borrower for non-payment of the project debt. To allow otherwise would be to allow the lender to have recourse to non-project assets, which would defeat the purpose of structuring the loan on limited or non-recourse terms in the first place.

This principle of limited recourse financing was recognised by the English courts as long ago as 1877 (and possibly earlier) in the well-known case of Williams v. Hathaway (1877) 6 CH D 544. In this case, a sum of money (the fund) was paid by way of recompense by a railway company to the vicar of a parish and the incumbent of an ecclesiastical district in accordance with an Act of Parliament which authorised the railway company to take a certain church for its purposes. The Act directed, in effect, that the money be applied by the recipients to provide a new church and parsonage. The recipients of the fund contracted with a builder to build the church and parsonage and the project proceeded. In the event, the cost of the works exceeded the monies in the fund and the builder took legal action to recover the deficiency. Jessel MR, held, inter alia, that it was permissible for a proviso to a covenant to pay to limit the personal liability under the covenant to pay without destroying it. Despite the fact that the contractual arrangements were with the individuals who were for the time being trustees of the fund, it was held that “the object [of the contractual instrument] is to bind the fund” and not the trustees in their personal capacity.

Why choose project finance?

Before examining how projects are structured and financed, it is worth asking why sponsors choose project finance to fund their projects. Project finance is invariably more expensive than raising corporate funding. Also, and importantly, it takes considerably more time to organise and involves a considerable dedication of management time and expertise in implementing, monitoring and administering the loan during the life of the project. There must, therefore, be compelling reasons for sponsors to choose this route for financing a particular project.

The following are some of the more obvious reasons why project finance might be chosen:

- The sponsors may want to insulate themselves from both the project debt and the risk of any failure of the project

- A desire on the part of sponsors not to have to consolidate the project’s debt on to their own balance sheets. This will, of course, depend on the particular accounting and/or legal requirements applicable to each sponsor. However, with the trend these days in many countries for a company’s balance sheet to reflect substance over form, this is likely to become less of a reason for sponsors to select project finance (the implementation in the UK of the recent accounting standard on “Reporting the Substance of Transactions” (FRS 5) is an example of this trend)

- There may be a genuine desire on the part of the sponsors to share some of the risk in a large project with others. It may be that in the case of some smaller companies their balance sheets are simply not strong enough to raise the necessary finance to invest in a project on their own and the only way in which they can raise the necessary finance is on a project financing basis

- A sponsor may be constrained in its ability to borrow the necessary funds for the project, either through financial covenants in its corporate loan documentation or borrowing restrictions in its statutes

- Where a sponsor is investing in a project with others on a joint venture basis, it can be extremely difficult to agree a risk-sharing basis for investment acceptable to all the co-sponsors. In such a case, investing through a special purpose vehicle on a limited recourse basis can have significant attractions

- There may be tax advantages (e.g. in the form of tax holidays or other tax concessions) in a particular jurisdiction that make financing a project in a particular way very attractive to the sponsors

- Legislation in particular jurisdictions may indirectly force the sponsors to follow the project finance route (e.g. where a locally incorporated vehicle must be set up to own the project’s assets).

This is not an exhaustive list, but it is likely that one or more of these reasons will feature in the minds of sponsors which have elected to finance a project on limited recourse terms. Project finance, therefore, has many attractions for sponsors. It also has attractions for the host government. These might include the following:

- Attraction of foreign investment

- Acquisition of foreign skills and know-how

- Reduction of public sector borrowing requirement by relying on foreign or private funding of projects

- Possibility of developing what might otherwise be non-priority projects

- Education and training for local workforce.

Structuring the project vehicle

One of the first, and most important, issues that the project sponsors will face in deciding how to finance a particular project will be how to invest in, and fund, the project. There are a number of different structures available to sponsors for this purpose. The most common structures used are:

- A joint venture or other similar unincorporated association

- A partnership

- A limited partnership

- An incorporated body, such as a limited company (probably the most common).

Of these structures the joint venture and limited company structure are the most universally used.

A joint venture is a purely contractual arrangement pursuant to which a number of entities pursue a joint business activity. Each party will bring to the project not only its particular expertise but will be responsible for funding its own share of project costs, whether from its own revenues or an outside source. Practical difficulties may arise as there is no single project entity to acquire or own assets or employ personnel, but this is usually overcome by appointing one of the parties as operator or manager, with a greater degree of overall responsibility for the management and operation of the project. This is the most common structure used in the financing of oil and gas projects in the UK continental shelf. Partnerships are, like joint ventures, relatively simple to create and operate but, in many jurisdictions, partnership legislation imposes additional duties on the partners, some of which (such as the duty to act in the utmost good faith) cannot be excluded by agreement. Liability is unlimited other than for the limited partners in a limited partnership, but these are essentially “sleeping” partners who provide project capital and are excluded from involvement in the project on behalf of the firm.

In many cases it will not be convenient (or may not be possible) for the project assets to be held directly (whether by an operator or the individual sponsors) and in these cases it may be appropriate to establish a company or other vehicle which will hold the project assets and become the borrowing vehicle for the project. The sponsors will hold the shares in this company or other vehicle in agreed proportions. In most cases where this route is followed, the company or other vehicle would be a special purpose vehicle established exclusively for the purposes of the project and the use of the special purpose vehicle for any purposes unconnected with the project in question will be published. In addition to the constitutional documents establishing the vehicle, the terms on which it is to be owned and operated will be set out in a sponsors’ or shareholders’ agreement.

Whether sponsors follow the joint venture (direct investment) route or the special purpose vehicle (indirect investment) route ultimately will depend on a number of legal, tax, accounting and regulatory issues, both in the home country of each of the sponsors and in the host country of the project (and, perhaps, other relevant jurisdictions). Some of the relevant influencing factors might include the following:

- A wish on the part of the project sponsors to isolate the project (and, therefore, distance themselves from it) in a special purpose vehicle. If the project should subsequently fail, the lenders will have no recourse to the sponsors, other than in respect of any completion or other guarantees given by the sponsors (see section 6.5 for an explanation of such guarantees). The sponsors are effectively limiting their exposure to the project to the value of the equity and/or subordinated debt that they have contributed to the project

- The use of a joint venture or partnership, as opposed to a special purpose vehicle, can often mean that the sponsors must assume joint and several liability when contracting with third parties on behalf of the joint venture or partnership. If the borrowing for the project is through the joint venture or partnership, this is likely to result in each sponsor having to show the full amount of the project debt on its balance sheet, not a particularly attractive proposition for most project sponsors.

- By contrast, the use of a special purpose vehicle may mean that the sponsors do not have to consolidate the project debt into their own balance sheets (if it is not a “subsidiary” or “subsidiary undertaking” or equivalent). This may also be important for cross-default purposes for the sponsor. A sponsor would not want a default by a project company (even if it is a subsidiary) to trigger a cross-default in respect of other contracts or projects at sponsor level. The corporate lenders to the sponsor may agree to this, provided there is no recourse by the project’s lenders to the sponsor in the event of a project company default, eliminating the risk that the project company default will damage or further damage the sponsor’s balance sheet (note the wide definition of “project finance borrowing” used earlier in this section that typically might be used in such a case)

- On a similar note, negative pledge covenants in a sponsor’s corporate loan documentation may prohibit or limit the sponsor from creating the necessary security required in connection with a project financing. As with the cross-default clause, the corporate lenders to the sponsor may agree to exclude security interests created by the sponsor (or a subsidiary or subsidiary undertaking of the sponsor) in connection with a specific project from the terms of the sponsor’s negative pledge

- It may be a host government requirement that any foreign investment is channelled through a local company, particularly where the granting of a concession might be involved. This may be for regulatory or tax reasons or, in the case of a strategically important industry, for security or policy reasons

- The use of a joint venture or partnership can have significant tax advantages in some jurisdictions (e.g. each participant may be taxed individually and may have the ability to take all tax losses on to its own balance sheet) which may make such a vehicle attractive for some sponsors. On the other hand, a limited liability company’s profits are in effect taxed twice, once in the hands of the company and again in the hands of the individual shareholders

- A special purpose vehicle will be attractive where different sponsors require to fund their investment in the project in different ways (e.g. one may want to borrow whilst others may wish to fund the investment from internal company sources) or one may want to subscribe equity whereas another might wish to contribute debt as well (e.g. subordinate the repayment of this debt to the right of project lenders) and

- Practical considerations may also be relevant. Partnerships and contractual joint ventures are less complicated (and cheaper) to establish and operate. Registration requirements in respect of limited companies and limited partnerships eliminate confidentiality. It should also be remembered that it is easier for a company to grant security, in particular floating charges, and this may be an important consideration for the raising of finance.

In the event, the choice will never be a straightforward one and it is often the case that sponsors will have conflicting requirements. This will be one of the many challenges for those involved in project financing. It is, however, important to establish the appropriate vehicle at the outset as it can be difficult to change the vehicle once the project proceeds and, especially, once the funding structure is in place.

Key sponsor issues

Having settled on the structure of the project vehicle, it will then be necessary for the sponsors to agree at an early stage on a number of other key matters. These will include:

- The respective roles in the project of each sponsor (e.g. who will deal with the technical aspects of the project, negotiate the concession, negotiate with the lenders, arrange the project insurances, negotiate with suppliers/offtakers, oversee the establishment of the project vehicle, arrange for the necessary consents and permits). Frequently the allocation of such tasks will have been dictated already in the make-up of the sponsor group, but it is important for each sponsor to have a clear understanding at an early stage of what tasks it is to perform

- The appointment of advisers to the project. The two key appointments will be the appointment of financial and legal advisers to the project. However, other advisers, such as technical, insurance, environmental and market risk advisers, may also be required, depending on the circumstances of a particular project

- The capitalisation of the project or project company. How much capital will be put in, when will this be injected and by what method? There is no hard-and-fast rule for determining how much sponsor capital must be injected into a project. Some projects have been structured on the basis that the sponsors have put up only a nominal amount of capital (called “pinpoint capital”). More typically, however, one might expect to see an overall debt/equity ratio in the 90/10 to 75/25, range depending on the dynamics of a particular project. Most lenders will require that sponsor capital is injected at the outset, and before the banks start funding the project company. They may, however, relax this position if they are satisfied as to the credit standing of the sponsors or have received security (such as a bank guarantee or letter of credit) to secure the sponsor’s capital commitment. Shareholder funds are usually injected by way of a subscription for shares of the project company, although there is usually no objection to shareholder loans so long as these are subordinated to the lenders’ loans and are non-interest bearing (or at least the requirement to pay interest is suspended until dividends are permitted to be paid (see below))

- The dividend/distribution policy of the sponsors. This will frequently be a source of much debate with the project lenders. On the one hand, most sponsors will be keen to extract profits at an early stage. The project lenders, however, will not be keen to see the sponsors taking out profits until the project has established and proved itself and the project lenders have been repaid at least some of their loans. It would be unusual for the project lenders to permit the payment of dividends (or the payment of interest on subordinated loans) prior to the date of the first repayment of the project loan and then only if the key project cover ratios will be satisfied after the payment of the dividends (see section 8.5 for an explanation of key cover ratios)

- Management of the project vehicle. Who will undertake this and how? Will the project vehicle have its own employees and management or will these be supplied by one or more of the sponsors? If one or more of the sponsors is to supply management and/or technical assistance to the project company, then the lenders will expect to see this arrangement formalised in an agreement between the sponsor in question and the project company

- Sale of shares and pre-emption rights. This will be of concern to sponsors and lenders alike. In particular, the lenders will want the comfort of knowing that the sponsor group that has persuaded them to lend to the project company in the first place will continue to be in place until the loans have been repaid in full.

Project implementation and management

The implementation of a project financing is a complicated, time-consuming and difficult operation. For most projects it is a case of years rather than months from inception of the project to reach financial close. It is not unheard of for some complex (and, perhaps, politically sensitive) projects to have a gestation period in excess of five years. The chart in Fig. 3 is an illustration of the more important milestones for a typical project and how long one might expect the process to take. However, each project will have a unique timetable, driven largely by the particular dynamics and circumstances of the project.

With so many parties involved having conflicting interests, the issue of effective project management assumes great significance in most project financings. It does not matter whether the overall responsibility is assumed by the sponsors (and their advisers) or by the lenders (and their advisers). What is crucial, however, is that one of the influential parties assumes overall control for managing the project from its inception to financial close. Without effective project management, a project can very easily go off the rails, with each of the parties singularly concentrating on issues and documents that are relevant to it. Because of the need to understand all aspects of the project with a view to assessing the overall risk profile, it is often the lenders (and their advisers) who are in the best position to manage effectively and steer a project to financial close.

Parties to a Project Financing

One of the complicating (and interesting) features of most projects is the considerable number of parties with differing interests that are brought together with the common aim of being involved to a greater or lesser extent with a successful project. It is one of the challenges of those involved with a project to ensure that all of these parties can work together efficiently and successfully and cooperate in achieving the project’s overall targets. It is inevitably the case that, although all of the parties will share the same overall aim in ensuring that the project is successful, their individual interests will vary considerably and, in many cases, will conflict. With many projects, there will be an international aspect which will involve different project parties located in different jurisdictions and there will often be tensions between laws and practices differing from one country to another.

Project Financing Documentation

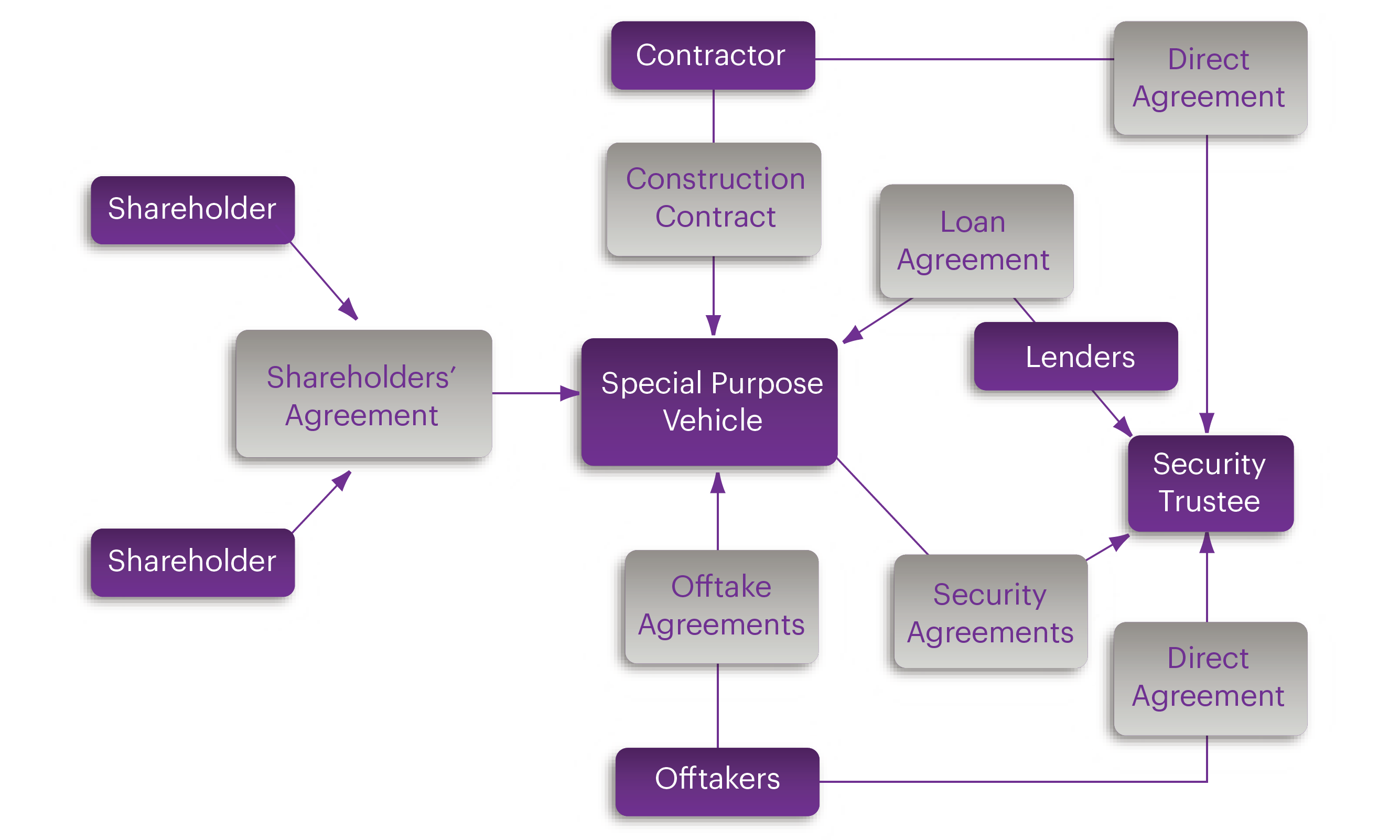

The essence of project financing is the apportionment of the project and other risks amongst the various parties having an interest in that project. The way in which this risk allocation is implemented is, essentially, through the complex matrix of contractual relations between the various project parties as enshrined in the documentation entered into between them. There is no general body of law in England (or elsewhere) that dictates how projects must be structured or how the risks should be shared amongst the project parties. Rather, each project must fit within the legal and regulatory framework in the various jurisdictions in which it is being undertaken or implemented. Accordingly, the contracts between the various project parties assume a huge significance and it is these documents that are the instruments by which many of the project risks are shared amongst the project parties. As will be apparent, there is no such thing as a standard set of project documents. Each project will have its own set of documents specially crafted for that particular project. Set out below is a brief description of some of the key documents found in many project financing structures. These documents can conveniently be grouped as follows:

- Shareholder/sponsor arrangements

- Loan and security documents

- Project documents.

Project Structures

Approach to financing

We have already seen that sponsors may choose to raise finance directly themselves for financing a project or indirectly through a project vehicle. If they choose the direct financing route then the financing may be raised either on conventional balance sheet terms or on limited recourse terms. Indeed, whichever of these routes is followed, the vast majority of projects worldwide that are debt financed are financed using loans as opposed to other forms of finance. That is not to say that other forms of finance are not available for projects; it is simply that the flexibility offered by loan structures makes them appealing for many project sponsors.

Although the great majority of limited recourse funding for projects is raised through the international capital markets by way of loans, usually on a syndicated basis, it is unlikely that the structure for any one project will be identical to the structure used in another project, although there may very well be strong similarities. There are, however, certain templates that have been developed by bankers, lawyers and others and this section will examine a number of the more commonly used templates. Some hypothetical projects will be used in order to make these structures more readily understandable.

There are two sources of finance for projects, apart from loans, that are sometimes utilised each one of those has a different structure from the conventional loan structure. These are outlined below.

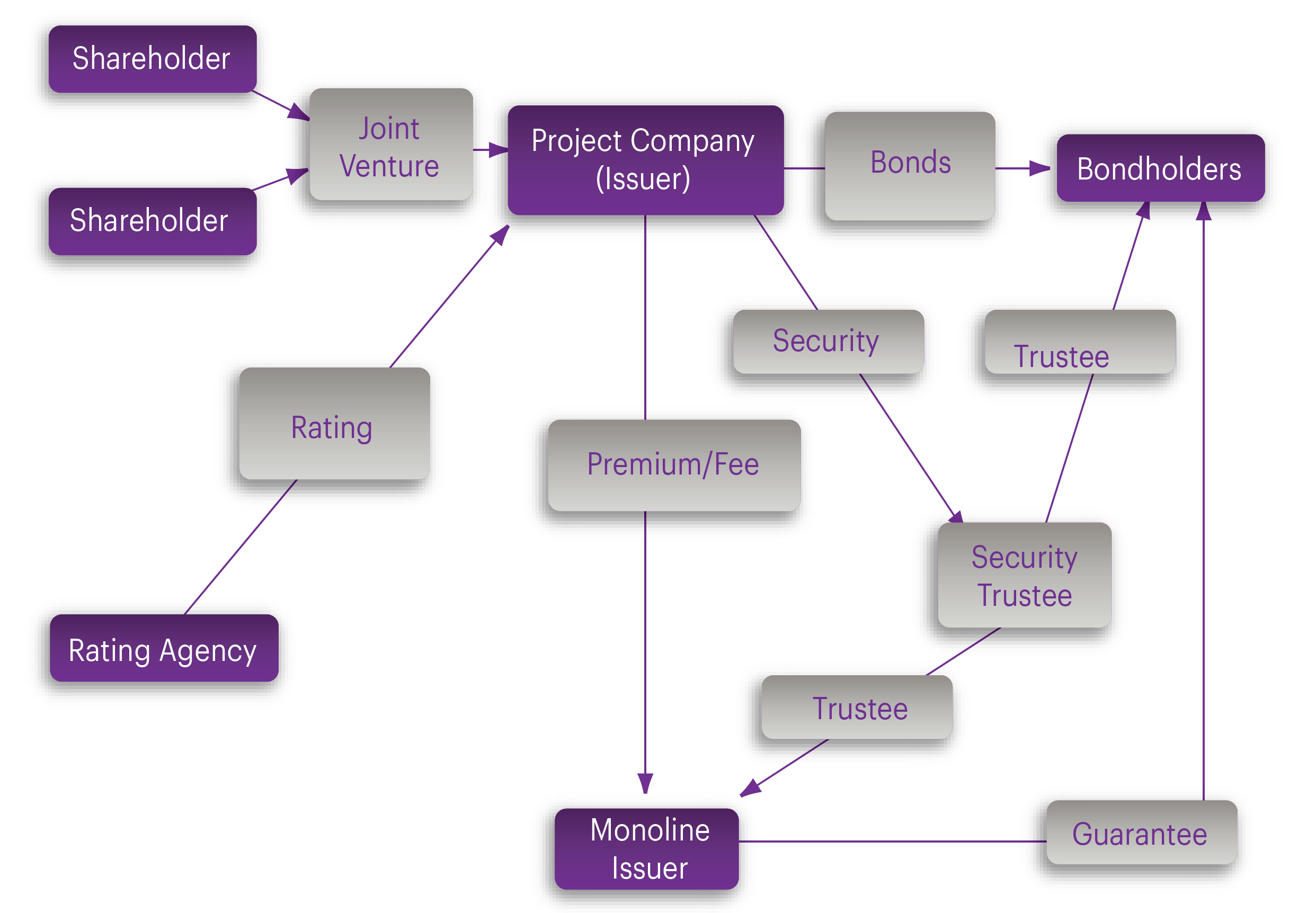

Bonds

A potential source of finance for projects is the bond market. In the US, many projects have been funded by bonds and in the UK a number of the Government’s Private Finance Initiative (PFI) projects were funded using bonds (the majority with monoline insurance cover and some where the bondholders were taking pure project risk). However, whilst the bond market has been an important source of funds for projects, it is likely that the vast majority of projects will be financed through loans rather than bonds as loans are seen as more flexible. The main attraction of the bond market is the availability of long-term fixed rate funding, which is not only generally cheaper than bank borrowing but also offers the possibility of lengthening the repayment profile of the project debt which can improve the project’s economics significantly. However, there are a number of disadvantages to using bonds to finance projects, including the following:

- Consents and waivers from the lenders are frequently sought in project financings and it is considerably more difficult to obtain these from (often unidentifiable) bondholders. Bond trustees will have certain discretions but these may not be wide enough to cover either material changes to project timetables etc. or the situation where a project runs into difficulties

- Bonds tend to be structured on the basis that payment by the bondholders is in one large sum at closing. This does not fit very well with most project structures where drawdowns by the project company are usually made periodically against, say, an engineer’s or architect’s certificate confirming completion of a relevant project milestone. The solution to this in most bond financings is to deposit the bond proceeds in a deposit account with the bond security trustee and allow withdrawals by the project company in much the same way as drawdowns under a conventional loan structure. However, there are two difficult issues here. First, what happens to these funds if there is a default before they are withdrawn - do they belong to the bondholders, the lenders or the project company? Second, it will almost certainly be the case that the interest rate on the deposit account will be less than the interest rate payable on the bonds - the “negative carry effect” as it is commonly referred to. This can be a significant additional cost for the project and will need to be taken into account when measuring the attractions of a project bond

- Bonds tend to have less onerous warranties, covenants and events of default compared with loans. One of the reasons for this is that because, in many cases, bondholders are anonymous it is much more difficult, expensive and cumbersome to arrange meetings of bondholders for the purposes of determining what action should be taken as a result of any defaults. Accordingly, bond trustees have a vested interest in structuring bond documentation so as to avoid insignificant events amounting to defaults. This, of course, conflicts with the approach of project finance lenders whose usual approach is to cast warranties, covenants and events of default in very strict terms so as to maintain a high degree of control over the project.

Another reason advanced in favour of loans is the likely lack of appetite by bond investors for pure project risks. Typically the bond market likes to invest in sound companies with strong balance sheets rather than the speculative more risky ventures. This is not to say that some potential bond investors may not have an appetite for project risk (and there is clearly evidence that there is a project bond market in the US and that there is a market emerging in the UK), but they are unlikely to be able to satisfy anything other than a very small proportion of the projects looking to raise finance. One significant development in recent years, however, has been the liberalising of the US securities markets towards overseas issuers. A key change was the introduction by the US Securities and Exchange Commission (SEC) in 1990 of Rule 144A under the US Securities Act of 1933. Rule 144A sets forth a non-exclusive safe harbour from the registration requirements of the Securities Act for the resale of certain privately placed securities to large institutional investors (“Qualified Institutional Buyers” or “QIBs”) by persons other than the issuer of such securities. Thus, transactions meeting the requirements of Rule 144A are not subject to the relatively onerous and expensive registration requirements of the Securities Act, including the requirement that financial statements of the issuer be reconciled to US generally accepted accounting principles. This has made it significantly easier and cheaper for a non-US issuer to tap the huge institutional capital markets in the US and a number of sponsors have taken advantage of this to fund all or a part of a project’s financing requirements. An example of a bond structure for a project is set out below.

Leasing

Lease finance is also a possibility, particularly in projects involving heavy capital goods. However, to date, leasing has only played a very small part in the overall financial equation and there are no real signs that the lessor market in the UK is opening up to large scale infrastructure projects. There are a number of reasons for this. First, the tax capacity available in the UK for investing in such projects is fairly limited. The available tax capacity quickly gets used up by the small to medium ticket lease market. At the big ticket end of the market, most of the financing has been done on assets such as ships, aircraft and (more recently) satellites. It is easy to see why institutional lessors prefer to finance these types of capital assets rather than investing in, say, turbines for a power project. Second, there are ownership liabilities that go hand-in-hand with leasing capital equipment that cannot always be satisfactorily laid off through documentation. Lessors traditionally are very risk averse creatures and, therefore, the prospect of becoming embroiled in complex disputes in a project where they may be the owner of one of the principal assets in question is not an appealing one to them. Third, the introduction of a lessor into a project structure will add considerably to the complexity of the overall structure and, therefore, to the documentation to an extent that the possible tax advantages may very well not be wholly justified by the additional complexities and expense involved.

In those areas where finance leases have been put in place for projects in the UK (mainly power stations and cable financings) they have usually been structured on the basis that the finance lessor does not take any project risk and the “tax risk” is shared with the lenders.

So far as the project risk is concerned, the finance lessor would generally look to receive a guarantee or letter of credit to cover it against any project risk that it may be exposed to. This principle is usually acceptable to all parties as these are risks that the lenders will be accustomed to assuming. The issue of tax risk, however, is not always so easy to solve. Tax risk is the risk that there is an adjustment in the tax regime in a manner which reduces or eliminates the anticipated tax benefit of the lease. The variation of tax rates, the availability of tax allowances, the rules on group relief etc., could all have an adverse effect on the lease cash flows and economics of the project as a whole. The problem, of course, for finance lessors is that if they are to assume any of the tax risks they are, in effect, also taking a credit risk on the project company and, therefore, in effect, in the project itself. Another difficult issue with introducing leasing into project financing is the intercreditor arrangements between the lenders and the lessor. Although both groups will share many of the same objectives in respect of the project, there will be areas where their interests conflict. A dramatic example of this would be where there is a default under the lease that entitles the lessor to terminate the lease and dispose of the plant and equipment being leased. This, of course, is something that would not be acceptable to the lenders and so an arrangement has to be reached between them whereby the lessor forgoes its right to terminate the lease automatically in these circumstances. One solution in such circumstances is for the lenders to set up a company to buy out the lease thereby allowing the lessor to be paid out. However, this will not always be an acceptable solution to the parties. Other difficult issues include the relative degree of control and supervision that may be exercised by each party. Intercreditor negotiations between lenders and lessors can be extremely difficult and time consuming, but this may be a price worth paying if the overall tax benefits for the project company are significant.

North Sea model

As with most infrastructure projects, oil and gas projects in the North Sea can be conveniently split into the development/construction phase and the operating/producing phase. In the early days of financing North Sea oil and gas projects, lenders were wary of taking risks during the development/construction phase and would usually seek to pass these risks on to the sponsors. Traditionally, this was done in one of two ways. If the project financing vehicle was a special purpose vehicle and had no assets beyond the project being financed, then the lenders would require either a completion guarantee or a cost overrun guarantee or a combination of both. They would also be likely to require some form of management and technical assistance support so that they could feel comfortable that the project company would have the necessary management and technical resources available to it to undertake the project. Where the special purpose vehicle route is not used and instead the sponsor raises limited recourse funds directly, then the transaction is usually structured so that the loans are drawn down on the basis that they are full recourse loans to the sponsor until “converted” into limited recourse loans. Typically, conversion would take place when the lenders are satisfied that mechanical completion of the platform and other facilities has occurred and certain operating tests have been completed to the satisfaction of the independent engineers acting for the lenders. There will usually be a number of other conditions precedent to conversion. One of these conditions is likely to be the provision of the full security package for the loan (which will probably not have been provided at the outset so long as the loan remains a corporate loan) and another is likely to be the satisfaction of certain cover ratios immediately following conversion. Some loans have been structured on the basis that if the conversion of the full amount of the loan will result in any of the cover ratios being infringed, then only a proportion of the loan will be converted. (The use of cover ratios in project financing is discussed in section 8.5.)

As most developments in the North Sea are undertaken on a joint venture basis, this has implications for the lenders. Most of the financings in the North Sea have been structured on the basis that individual participants in a production licence are obliged to raise finance themselves for meeting their share of development and operating costs in connection with the project. In some production licences, this will mean that some of the participants will finance their share of costs from their own resources whilst others might raise limited recourse finance to finance their share. The principal security available for lenders is the interest of the participant in the production licence, the field facilities, the operating agreement (or joint venture agreement), any transportation contracts and sales/offtake contracts, the hydrocarbons being produced (but not whilst in the ground when they remain vested in the Crown) and the project insurances. This is a not untypical list of assets over which a lender would seek to take security, but in the context of the North Sea there are some problem areas for lenders. One of these is the likelihood that the operating (or joint venture) agreement among the participants is likely to contain forfeiture (or withering) provisions where an individual participant is in default in meeting cash calls or otherwise under the operating (or joint venture) agreement. A lender’s security is, in these circumstances, likely to be subordinated to the interest of the other participants and this will diminish the value of the security for the lenders. Another issue for lenders is that, although it is possible to take charge over exploration and production licences, the Department of Energy will need to consent prior to any actual enforcement of this security and to approve any proposed transferee of a licence. Obviously there is an element of risk here for the lenders that this consent/approval may not be forthcoming.

Lenders have, however, over the years become quite comfortable with limited recourse financing in the North Sea and have shown an appetite for being prepared to accept the project, legal and political risks associated with lending on a limited recourse basis.

Borrowing Base model

Whilst the norm is for projects to be financed on a single project basis, this is not exclusively the case. The borrowing base model is one that was developed in the US, in particular, in relation to the financing of oil and gas assets. Using this approach, borrowers would be entitled to draw down funds for financing one or more designated projects subject to the satisfaction of one or more overall borrowing base cover ratios being satisfied. In other words, so long as the aggregated future cash flows from all the projects covered the total loans and the servicing of them, the lender would not concern itself with the fact that, when viewed on a project-by-project basis, a borrower might not satisfy the usual cover ratios specified by the lender for a one-off project. In order to safeguard its loans, the lender would take security over all of the assets included within the borrowing base formula.

This approach has proved extremely popular especially with the smaller US that would be able to use excess equity on one project to cover either start-up costs or cost overruns on another project.

This borrowing base model has been used for financing projects in the North Sea but only on an exceptional basis. For the very reason that it particularly suits smaller investments, it can be quite a cumbersome and expensive structure to establish for larger investments particularly those having a longer maturity (for example, in excess of five years, which is likely to be the case for most investments in the North Sea). There are also difficult security issues that arise, particularly with respect to the cross-collateralisation aspects and persuading both the other field participants and the Department of Energy and Climate Change to accept this approach.

A variation on the borrowing base approach in the context of the North Sea has been the use of multi-field financing where, say, two or three fields are grouped together and financed at the same time. Although similar in approach to the borrowing base model, this is a less flexible approach in that it really amounts to one or more individual financings grouped together and cross-collateralised for security purposes. Some of the flexible features of the borrowing base approach will be available (e.g. use of surplus equity); others may not (such as use of loan proceeds).

The borrowing base or multi-field approach for the reasons stated above is likely to be of limited appeal to both sponsors and project lenders alike. The key advantages, however, of the borrowing base approach are:

- It is likely to be considerably cheaper in terms of establishment costs than the costs associated with establishing, say, three or four single field financings

- It is likely that less management time will be absorbed in administering the borrowing base facility

- Over-performing assets can be used to support under-performing assets and

- There may be flexibility within the borrowing base facility to substitute assets within the overall structure.

The disadvantages, on the other hand, are the cross-defaulting of all of the individual projects within the borrowing base structure, this is difficult to avoid. Also, it locks the sponsor into one group of lenders for all the relevant projects which might reduce both competition and flexibility.

“Build Operate Transfer” “BOT” model

Many projects around the world are structured and financed on the BOT model. There are a great number of varieties (and accompanying acronyms) and some of the more common are: DBFO: design, build, finance, operate DBOM: design, build, operate, maintain

BOT: build, operate, transfer DBOT: design, build, operate, transfer

FBOOT: finance, build, own, operate, transfer BOD: build, operate, deliver

BOO: build, own, operate BOOST: build, own, operate, subsidise, transfer

BOL: build, operate, lease BRT: build, rent, transfer

The basis for all projects structured on the BOT model is likely to be the granting of a concession or licence (or similar interest) for a period of years involving the transfer and re-transfer of all or some of the project assets. There are many definitions describing BOT projects and one of the more illustrative is:

“A project based on the granting of a concession by a principal, usually a government, to a promoter, sometimes known as the concessionaire, who is responsible for the construction, financing, operation and maintenance of a facility over the period of the concession before finally transferring to the principal, at no cost to the principal, a fully operational facility. During the concession period, the promoter owns and operates the facility and collects revenues in order to repay the financing and investment costs, maintains and operates the facility and makes a margin of profit.”

The key features are, therefore, the grant of a concession, the assumption of responsibility by the promoter (or sponsor) for the construction, operation and financing of the project and the re-transfer at the end of the concession period of the project assets to the grantor of the concession. A very common variant of the BOT model is the BOO (Build Own Operate) project which is structured on similar lines to a BOT project but without the re-transfer of project assets at the end of the concession period.

The concession agreement will, therefore, be the key project document and as such is likely to be examined with considerable care by the project lenders. From the concession grantor’s point of view, BOT and similar projects have a number of advantages. The principal advantages are:

- They offer a form of off-balance sheet financing as the lending in relation to the project will be undertaken by the project company

- Because the concession grantor (usually a government or government agency) will not have to borrow in order to develop the project, this will have a favourable impact on any constraints on public borrowing and will potentially free up funds for other priority projects

- It enables the concession grantor to transfer risks for construction, finance and operation of the facility to the private sector and

- It is a way of attracting and utilising foreign investment and technology.

Under the concession agreements, the project company will usually own and operate the project for the duration of the concession. The revenue produced by the project will be used by the project company to repay the project loans, operate the concession and recover the investment of the sponsors plus a profit margin. Overall, the structure is similar to many other project financings in that the project loans will usually be provided direct to the project company (which is likely to be a subsidiary of the sponsors based in the host country) and the lenders will take security over (principally) the project company’s rights under the concession agreement together with any other available project assets.

The principal terms of a concession agreement for a typical BOT project are set out in Principal Terms of a Concession Agreement below:

Principal Terms of a Concession Agreement

Concession grantor’s obligations

- Granting to the project company an exclusive licence to build and operate the project for the stipulated concession period• Acquiring the project site and transferring it to the project company

- Making and obtaining required compulsory purchase orders for land

- Providing required consents and licences

- Making an environmental assessment

- Passing enabling legislation if required

- Constructing connecting and ancillary services (including roads)

- Granting, where applicable, tax concessions/holidays

- (possibly) provision of raw materials and purchase of offtake

- (Possibly) an agreement to compensate the project company against certain risks such as uninsurable force majeure risks and change in law/tax risks and• Granting to the project company the right to termination of the concession (with compensation) following a default by the concession grantor.

Project company’s obligations

- To acquire the project site from the concession grantor

- To finance, construct, operate and maintain the project to the contract specification (which may be variable by the concession grantor either with or without compensation)

- To comply with certain standards of construction work (and to permit the concession grantor access to the site for progress checks and monitoring)

- To complete the project by the specified date (and to provide guarantees or bonds as to performance)

- To comply with all applicable legislation. If the concession grantor (being a state entity) introduces new legislation that increases the cost to the project company of carrying out the project, then the concession agreement may include compensation terms for the project company

- Where appropriate, to enter into sales or other offtake contracts in respect of the project’s products

- To permit the concession grantor to terminate the concession upon default by the project company

- To train the concession grantor’s staff of the concession grantor prior to re-transfer

- (Possibly) to transfer the project assets to the concession grantor at the expiration of the concession.

Where the concession is in respect of a public transport facility, the concession may well provide for control of the level of charges, permitted adjustments and the duration of the period when charges can be levied. In return for any restrictions on charges, the concession grantor may agree to pay a subsidy or guarantee a minimum level of demand.

In the event of a default by the project company of any of the terms of the concession, or the occurrence of some other event which makes it unlikely that the project will be completed, the concession grantor will wish to have the ability to terminate the concession and/or take over the project company in order to complete the project itself. Of course, the project lenders will be concerned about any rights which the concession grantor has to terminate the concession agreement or to alter any of the terms of the concession agreement in a way that is likely to impact on their financing arrangements. They are also likely to want the ability to step in themselves and take over the project company’s rights under the concession agreement in certain circumstances (see section 6.6 for a further description of step in procedures and direct agreements).

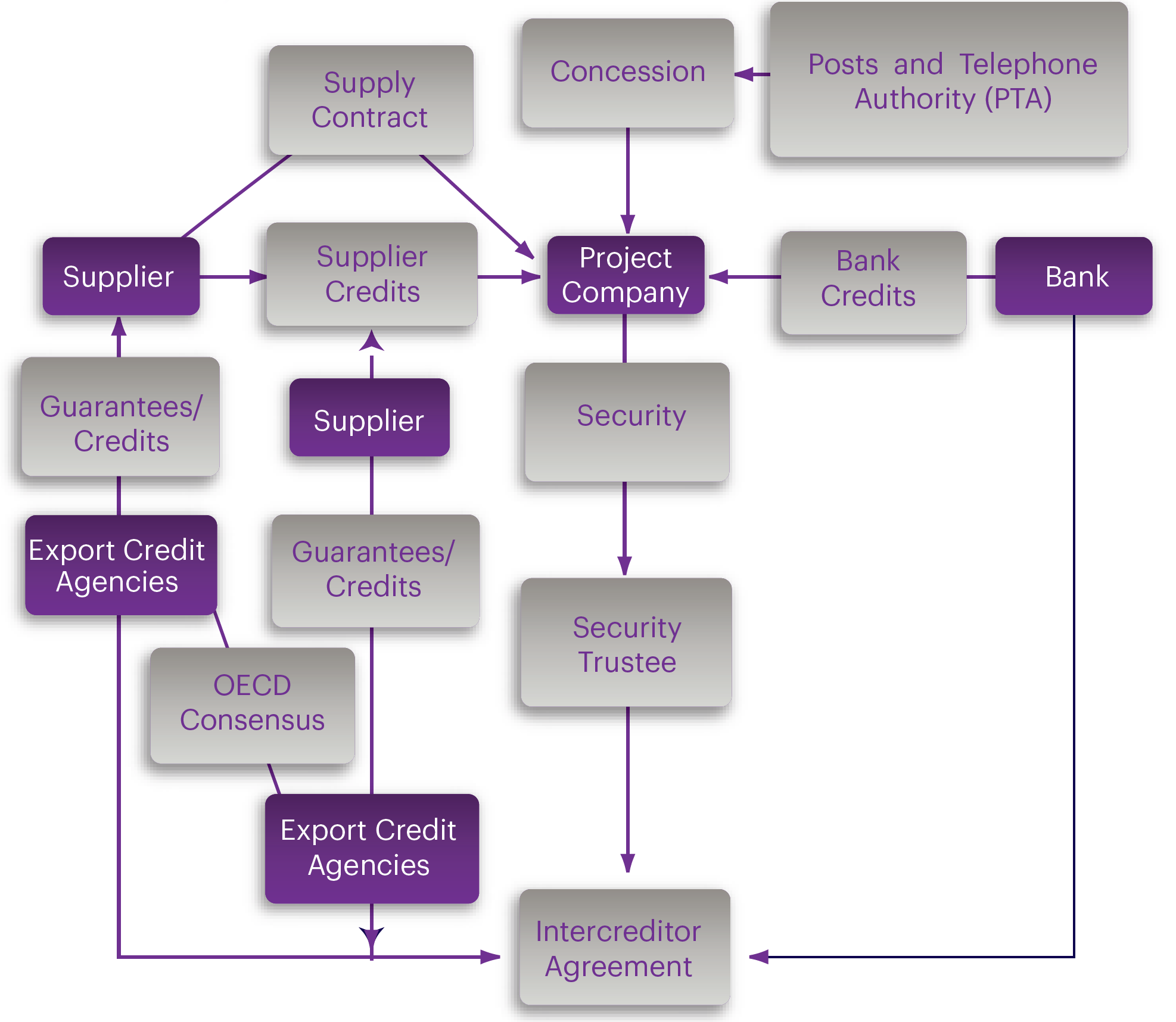

An example of a BOT model for a telecommunications project is set out can be seen below.

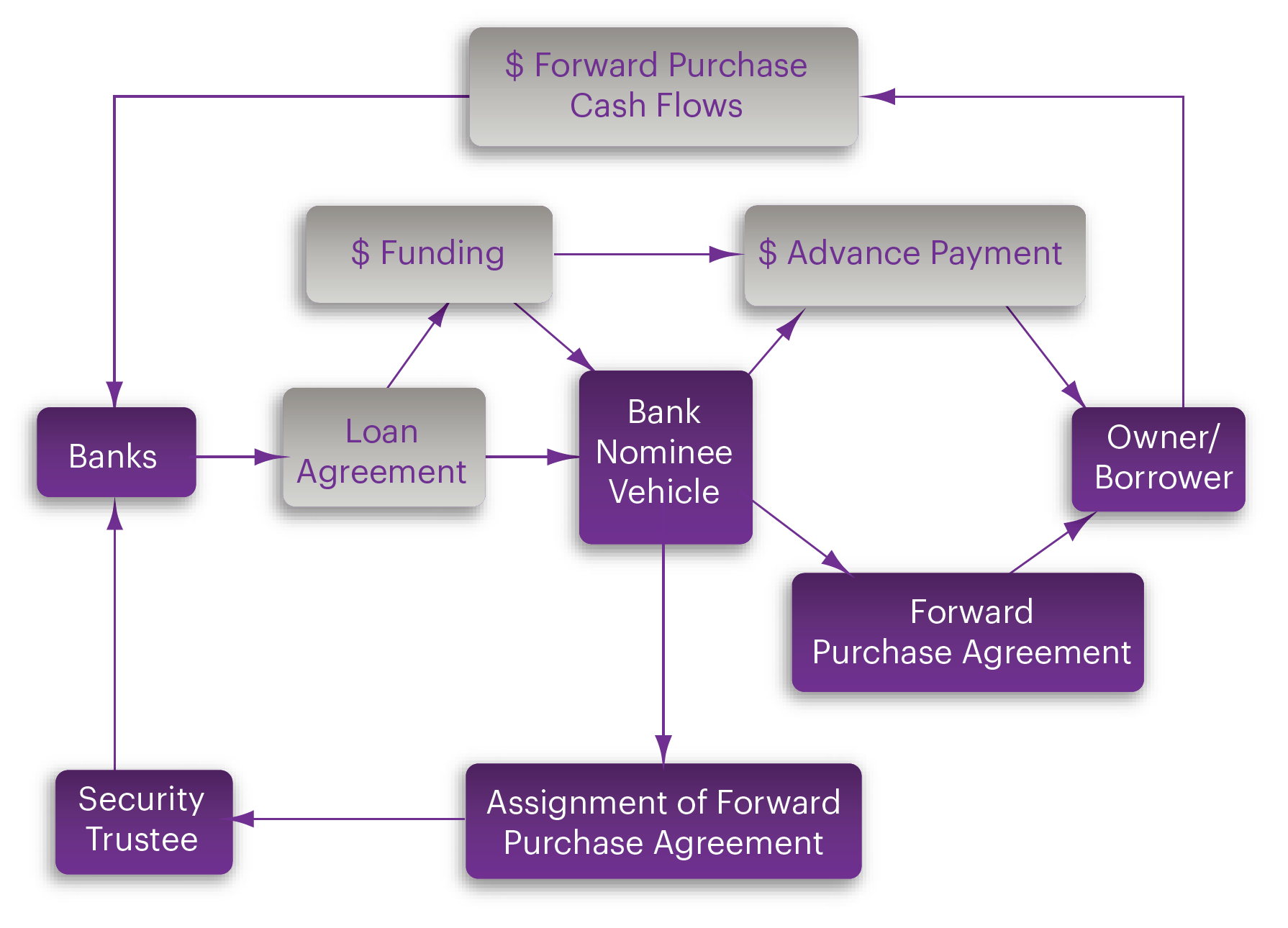

Forward Purchase model

Under this structure, sometimes known as an “Advance Payment Facility”, the project lenders will make an advance payment for the purchase of products generated by the project which will be deliverable to the lenders following completion of the project. The project company will utilise the proceeds of the advance payment towards financing the construction and development of the project. On delivery of the products following completion, the lenders will either sell the products on the market or sell them to the project company (or a related company of the project company) and use the proceeds to “repay” themselves. Alternatively, the project company may sell the products as sales agent for the lenders. Some structures entitle the project company to make a cash payment to the lenders in lieu of delivering products. A common feature of most structures, however, will be a requirement for an indemnity by the lenders for any loss or liability that the lenders may suffer or incur as a consequence of taking title to the products in question.

Sometimes a more complicated structure is used whereby another company, jointly owned by the lenders, acts as a vehicle through which the funding is passed. In such a case this vehicle will assign the benefit of the forward purchase agreement and any related agreements to the lenders by way of security. The introduction of this further stage is usually designed to remove the lenders from the commercial arrangements relating to the sale of products, often for regulatory reasons, but sometimes because the lenders will not want to take title to the products.

This type of structure has frequently been used as a way of circumventing borrowing restrictions. The argument is that a structure such as this does not amount to a borrowing nor would it infringe negative pledges and similar covenants. Whether or not this in fact achieves either or both of these objectives will depend on the legal and accounting rules in the particular country, but certainly the trend in the accountancy world these days is to look at the substance of the structure rather than accept the strict application of the documents.

Another reason for using this structure might be in circumstances where it is not possible for the lenders to obtain a perfected security interest in the assets being financed and the lender are not prepared to finance the project on an unsecured basis. This type of arrangement, if it is legally effective, will give the lenders title to the products produced by the project which is at least the equivalent of (and probably better than) security over those assets. Lenders participating in such transactions will obviously be concerned to ensure that, if a financing vehicle is not used, they are entitled under banking regulations applicable to them to participate in such “trading” activities. They will also be concerned that in the case of certain types of assets, such as oil and related products, they are not exposing themselves to any liabilities (e.g. pollution) that may arise through ownership (however briefly) of those assets. The existence of an indemnity from the project company will give some comfort on this issue, although the lenders will still be assuming an additional credit risk (in respect of the project company) for any amount that might be payable under this indemnity.

A similar structure is the “production payment” model frequently used in the US to achieve significant tax advantages. Under this structure the lenders (or a vehicle established by them) acquires a production (i.e. ownership) interest in a project. The lenders will then be entitled to an agreed share of the project’s production proportionate to the production payment that the lenders have acquired. The structure usually obliges the project company to repurchase the products delivered to the lender or to sell the products as agent for the lenders. The interest acquired by the lenders can either be an interest in the project itself (that is a right to, say, the agreed proportion of oil and gas or minerals that are produced) or an interest in the proceeds of sale of the products. The essential difference between the forward purchase structure and the production payment structure is that in a forward purchase transaction there is merely a contract to deliver and take the products as and when produced, whereas in a production payment transaction there is a conveyance or sale of the products (or the proceeds of sale of the products) in exchange for the purchase price. Both of these structures were occasionally in the very early days of financing in the North Sea Financing but have not been seen in the North Sea since. They are, however, still popular for certain types of projects (e.g. minerals). An example of a forward purchase structure is set out in the image below.

Sharing of Risks

Identification and allocation of risks

The essence of any project financing is the identification of all key risks associated with the project and the apportionment of those risks among the various parties participating in the project. Without a detailed analysis of these project risks at the outset the parties will not have a clear understanding of what obligations and liabilities they may be assuming in connection with the project and, therefore, will not be in a position to consider appropriate risk mitigation exercises at the appropriate time. Considerable delays can occur and expense can be incurred, should problems arise when the project is under way and arguments ensue as to who is responsible.

Thus, from the sponsor’s point of view, it will be particularly concerned to ensure that it has identified and understood all the risks that they will be assuming in connection with the project. It will want to be certain that it is are able to manage and monitor these risks effectively and, where they are not able to do so, either to pass them on to another party involved in the project that is better able to manage any particular risks (perhaps a supplier, contractor or purchaser of products) or, where this is not possible for any reason, perhaps to find some other way of managing the risk such as by taking out insurance or, more radically, altering the structure of the project to extinguish the risk or at least reduce it.

From the lenders’ perspective, they will have similar concerns. Additionally, they will have the following concerns:

- in assuming any risks associated with a particular project, they will need to be satisfied that there are no regulatory constraints imposed on them by any of the authorities that regulate their activities or pursuant to laws applicable to them

- they may have to report non-credit risks assumed by them in connection with their activities to their regulatory authorities

- generally speaking, the more risk that lenders are is expected to assume in connection with a project, the greater the reward in terms of interest and fees they will expect to receive from the project.

The task of identifying and analysing risks in any project is not one that can be left to any one party or its advisers. Rather, it is likely to involve the project parties themselves, accountants, lawyers, engineers and other experts who will all need to give their input and advice on the risks involved and how they might be managed. Only once the risks have been identified can the principal parties (the sponsors and the banks) decide who should bear which risks and on what terms and at what price.

Ground rules

There are some ground rules that should be observed by the parties involved in a project when determining which party should assume a particular risk:

- A detailed risk analysis should be undertaken at an early stage

- Risk allocation should be undertaken prior to detailed work on the project documentation

- As a general rule, a particular risk should be assumed by the party best able to manage and control that risk, e.g. the risk of cost overruns or delay on a construction project is best managed by the main contractor; in a power project, the power purchaser (if a state entity) is in a better position than others to assume the risks associated with a grid failure and consequent electricity supply problems for any reason

- Risks should not be “parked” with the project company, especially where the project company is a special purpose vehicle. The point here is that, where there is a disagreement between say, the fuel supplier and a power purchaser in a power project over which party should assume a particular risk, there may be a temptation to park the risk in question with the project company. However, this is simply storing up problems for the future as the project company will rarely be in a position to manage or control that risk, let alone pay for it.

Categories of project risks

The following is a list of some of the key project risks encountered in different types of projects. Of course, not all of these risks will necessarily be encountered in each project, but it is likely that most participants in projects will need to consider one or more of these risks and decide by whom these risks are to be assumed and how. It has already been seen in section 3 that, once these risks have been identified, it is through the various contractual arrangements between the parties, and insurance, that these risks are, for the most part, apportioned and assumed.

Construction/Completion Risk

In any infrastructure project involving a construction element, this is likely to be one of the key risks. Will the project be built on time, on budget and in accordance with the applicable specifications and performance criteria? In assessing these risks, the lenders in particular will be looking at the overall contract structure, the identity of the parties involved and factors such as whether the technology involved is proven. The key areas likely to be of concern to the lenders are:

- Type of contract: is the construction contract a “turnkey” contract with a prime contractor or are the design and works being undertaken by a series of consultants and contractors with project management being undertaken by the project company? Lenders have a strong preference for turnkey arrangements as this avoids gaps appearing in the contract structure and disputes between the contractors as to where particular responsibilities lie

- Price: lenders have a clear preference for fixed-price lump sum contracts. They will wish to be confident that the facility can be completed within the funding which has been committed and that cost overruns are the responsibility of the contractor. If there are to be any changes to the contract price, then the lenders will want to have a say on this particularly if this is as a result of changes to specifications on the part of the project company

* Completion: The lenders will want to ensure that there is a fixed date for completion with minimum ground entitling the contractor to extend the completion date. If there are any delays, then the lenders will want to see liquidated damages in an amount sufficient to cover the project company’s costs of servicing the loans and operating costs during the period of the delay. In practice, however, it is seldom possible to obtain full coverage in terms of liquidated damages for an unlimited period. What is generally negotiated is a fixed per diem amount subject to a cap. Under English law, a distinction is drawn between liquidated damages, which are a genuine pre-estimate of the damage likely to result from the breach of contract (failure to complete on time) and which are enforceable, and clauses which penalise the contractor unfairly and are unenforceable. A provision will generally be considered to be a penalty if the amount payable under the contract is extravagant and unconscionable compared with the greatest loss that could (at the time the contract was entered into) be conceived to flow from the breach. The wording used in the contract will be irrelevant; it is the substance of the clause which will be taken into consideration. One factor which may distinguish the contract provision as a penalty is if compensation is by way of a single lump sum which is payable on the occurrence of several events some of which would give rise to trivial damages, others of which would give rise to substantial damages. The lenders should, therefore, make sure that the liquidated damages are set at a carefully calculated and realistic rate in order to satisfy themselves that the provisions are enforceable.

Further, the risk of any delays that are not the fault of either the project company or the contractor will need to be addressed in any other project contracts that the project company is a party to. For example, if there is a delay as a result of a force majeure event that delays construction, then the force majeure provisions in any offtake contract under which the project company is required to deliver products from the project should take account of such delays and relieve the project company of liability:

* Force majeure: These provisions must be reasonable and the contractor should take all reasonable steps to circumvent the problem. They must not arise as a result of action or inaction on the part of the contractor or members of the contractor or people under the contractor’s control. Further, where insurance cover is available for force majeure events, then the lenders will want to see such insurance cover taken out or, if it is not, for others (the sponsors) to assume responsibility. See section 3.5 for a more detailed consideration of force majeure clauses

* Bonding requirements: The lenders will be concerned that appropriate performance and defects liability bonding is in place and from institutions with acceptable credit ratings. The amount of such bonds will depend upon the credit rating of the contractor and any parent company guarantees offered, and the payment profile during the contract. It is not uncommon for performance guarantees to be in the range 10 to 20 percent of the contract price (although in the US performance bonds of 100 per cent of the contract price are not uncommon). The lenders will expect the benefit of these bonds to be assigned to them

* Supervision: The lenders will require that their own engineer is entitled to inspect the construction works, receive reports and attend tests throughout the construction period and, where stage payments are used, that their engineer verifies that the appropriate works have been completed at the relevant time before the relevant drawdown under the facilities agreement is made.

It will usually be the case that all disbursements of the loan for construction-related payments (and indeed other significant items) will be channelled directly through the facility agent to the relevant payees. The lenders will not usually be prepared to release drawdowns direct to the project company and take the risk that these monies are not disbursed by the project company. (See section 8.2 for a more detailed description of the project accounts mechanism.)

If the lenders are unable to achieve these objectives (or at least most of them) in a manner satisfactory to them, then it is likely that they will look to the sponsors for some kind of completion support. They may well do so anyway in the case of sponsors who are undertaking the role of contractor.

Operating Risk

This is the risk that the project facility can be operated and maintained at levels and otherwise in a manner in accordance with the design specifications. Of particular concern to the lenders will be the following:

- Who is the operator? Does it have a proven track record of operating and maintaining similar projects efficiently?

- If the project company is also operating and maintaining the facility, does it have the necessary staff and skills?

- How are operating costs to be managed? Who is responsible for increases in operating costs?

- Is the operator also responsible for maintaining the facility or is there a separate maintenance contractor?

- The lenders will also be concerned that force majeure provisions in the operating agreement tie in with the other project agreements to which the project company is a party. In particular, any delays in production as a result of operating problems should not be the risk of the project company

- As with construction contracts, the lenders will be concerned that any breach of the operating agreement by the operator will give rise to liquidated damages payable to the project company at an acceptable level.

Not every project will have an independent operator and sometimes the project company itself will also be the operator. Whilst this reduces the risk of an additional party default, clearly the lenders will want to be satisfied that the project company has the experience and resources available to it to operate the project facility properly and to manage this risk. To this end, lenders may require sponsors to enter into agreements with the project company whereby the sponsors agree to provide management, personnel and technical assistance.

Market Risk

There are two principal elements here. First, there is the risk of whether or not there is a market for the project’s products of the project. Second, that the price at which the products can be sold is sufficient to service the project debt. Many projects are structured in such a way that long-term offtake contracts are entered into with third parties on terms such that this risk is wholly or partially covered. For example, in an independent power project the project may be structured so that a power purchase contract is entered into with the local state energy authority with a pricing mechanism containing a component that covers the operating costs of the project company as well as its debt servicing requirements (usually called a “capacity charge” or “availability charge”). Subject to assuming the credit risk of the offtaker in these circumstances, a properly structured contract in these terms should remove most of the market risk for the lenders.

Where there are no such guaranteed offtake arrangements, then the lenders are likely to have the following concerns: