Difference between revisions of "Parties to a Project Financing"

Abel Maciel (talk | contribs) (Created page with " ==Parties and their roles== One of the complicating (and interesting) features of most projects is the considerable number of parties with differing interests that are broug...") |

Abel Maciel (talk | contribs) |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

| + | [[Category: Project Management]] | ||

| + | [[Category: Project Finance]] | ||

| + | [[Category: Funding]] | ||

| + | [[Category: Procurement]] | ||

| + | [[Category: CBC]] | ||

| + | [[Category: Blockchain]] | ||

| + | [[Category: Construction]] | ||

| + | [[Category: Smart Contracts]] | ||

| + | [[Category: Construction Blockchain]] | ||

| + | |||

==Parties and their roles== | ==Parties and their roles== | ||

| − | One of the complicating (and interesting) features of most projects is the considerable number of parties with differing interests that are brought together with the common aim of being involved to a greater or lesser extent with a successful project. It is one of the challenges of those involved with a project to ensure that all of these parties can work together efficiently and successfully and cooperate in achieving the project’s overall targets. It is inevitably the case that, although all of the parties will share the same overall aim in ensuring that the project is successful, their individual interests will vary considerably and, in many cases, will conflict. With many projects, there will be an international aspect which will involve different project parties located in different jurisdictions and there will often be tensions between laws and practices differing from one country to another. | + | One of the complicating (and interesting) features of [[Project Finance | project finance]] in most projects is the considerable number of parties with differing interests that are brought together with the common aim of being involved to a greater or lesser extent with a successful project. It is one of the challenges of those involved with a project to ensure that all of these parties can work together efficiently and successfully and cooperate in achieving the project’s overall targets. It is inevitably the case that, although all of the parties will share the same overall aim in ensuring that the project is successful, their individual interests will vary considerably and, in many cases, will conflict. With many projects, there will be an international aspect which will involve different project parties located in different jurisdictions and there will often be tensions between laws and practices differing from one country to another. |

A common feature in many project structures is that different parties will have particular roles to play. This is especially so with many multi-sponsor projects where, for example, one sponsor may also be the turnkey contractor, whereas another sponsor may be the operator and yet another sponsor may be a supplier of key raw materials to the project or an offtaker of product from the project. Frequently it is the case (and sometimes a requirement of local laws) that one of the sponsors is a local company. Even in those countries where the involvement of a local company is not a requirement, this can have many advantages particularly where the foreign sponsors have limited experience of business practices or laws in the host country. Further, the involvement of a local company offers a degree of comfort, for the foreign sponsors and lenders alike, that the project as a whole will not be unfairly treated or discriminated against. | A common feature in many project structures is that different parties will have particular roles to play. This is especially so with many multi-sponsor projects where, for example, one sponsor may also be the turnkey contractor, whereas another sponsor may be the operator and yet another sponsor may be a supplier of key raw materials to the project or an offtaker of product from the project. Frequently it is the case (and sometimes a requirement of local laws) that one of the sponsors is a local company. Even in those countries where the involvement of a local company is not a requirement, this can have many advantages particularly where the foreign sponsors have limited experience of business practices or laws in the host country. Further, the involvement of a local company offers a degree of comfort, for the foreign sponsors and lenders alike, that the project as a whole will not be unfairly treated or discriminated against. | ||

Latest revision as of 11:00, 15 May 2020

Contents

- 1 Parties and their roles

- 2 Project company/borrower

- 3 Sponsors/shareholders

- 4 Third-party equity

- 5 Banks

- 6 Facility agent

- 7 Technical bank

- 8 Insurance bank/account bank

- 9 Multilateral and export credit agencies

- 10 Construction company

- 11 Operator

- 12 Experts

- 13 Host government

- 14 Suppliers

- 15 Purchasers

- 16 Insurers

- 17 Other parties

- 18 Summary of key lenders’ concerns

Parties and their roles

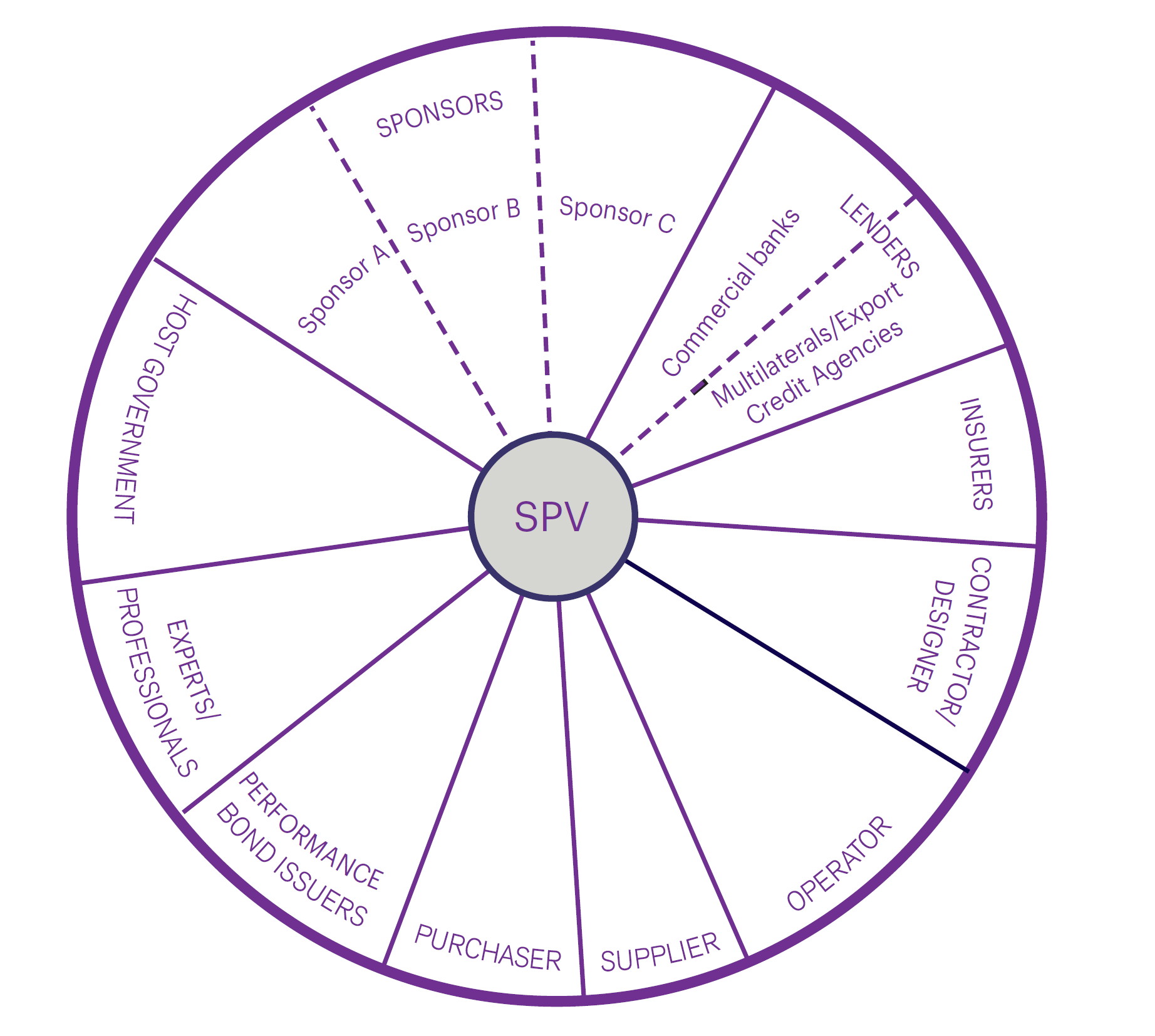

One of the complicating (and interesting) features of project finance in most projects is the considerable number of parties with differing interests that are brought together with the common aim of being involved to a greater or lesser extent with a successful project. It is one of the challenges of those involved with a project to ensure that all of these parties can work together efficiently and successfully and cooperate in achieving the project’s overall targets. It is inevitably the case that, although all of the parties will share the same overall aim in ensuring that the project is successful, their individual interests will vary considerably and, in many cases, will conflict. With many projects, there will be an international aspect which will involve different project parties located in different jurisdictions and there will often be tensions between laws and practices differing from one country to another.

A common feature in many project structures is that different parties will have particular roles to play. This is especially so with many multi-sponsor projects where, for example, one sponsor may also be the turnkey contractor, whereas another sponsor may be the operator and yet another sponsor may be a supplier of key raw materials to the project or an offtaker of product from the project. Frequently it is the case (and sometimes a requirement of local laws) that one of the sponsors is a local company. Even in those countries where the involvement of a local company is not a requirement, this can have many advantages particularly where the foreign sponsors have limited experience of business practices or laws in the host country. Further, the involvement of a local company offers a degree of comfort, for the foreign sponsors and lenders alike, that the project as a whole will not be unfairly treated or discriminated against.

No two projects will have the same cast of “players” but the following is a reasonably comprehensive list of the different parties likely to be involved in a project finance transaction.

Project company/borrower

The project company will usually be a company, partnership, limited partnership, joint venture or a combination of them. As noted in section 1.5, this will be influenced to a certain extent by the legal and regulatory framework of the host government. For example, in some jurisdictions it will be a legal requirement that the holder of a licence or concession be a company incorporated in that particular country. In other there may be strict requirements in particular industries as to foreign ownership of share capital or assets, particularly in strategically important industries.

The project company will in most cases be the vehicle that is raising the project finance and, therefore, will be the borrower. It will also usually be the company that is granted the concession or licence (in a concession-based financing) and who enters into the project documents. As has been seen in section 1, the project company is frequently a special purpose vehicle set up solely for the purposes of participating in a particular project. If the project vehicle is a joint venture then it is likely that there will be multiple borrowers. This can complicate the financing arrangements unless (as is likely to be the preference of the lenders) the joint venturers agree to be jointly and severally liable for the project’s debts. Where, however, the borrower is a special purpose vehicle, then the lenders would expect a newly incorporated company in the relevant jurisdiction and would seek to impose strict covenants on the ability of the borrower to undertake any non-project activities. The purpose of this is to ensure that the lenders are not exposed to any additional risks unrelated to the project itself. An example of the type and scope of such covenants is set out below.

Single Purpose Vehicle Covenants

The Project Company shall not:

- engage in any business or activity, apart from the ownership, management and operation of the Project and activities ancillary thereto as permitted by this Agreement and the Security Documents or

- save as contemplated in the Security Documents, create, incur or permit to subsist any Security Interest over all or any of its present or future assets, other than any Security Interest arising by operation of law and discharged within 30 days or

- make any advances, grant any credit (save in the routine course of its day-to-day business) or give any guarantee or indemnity to, or for the benefit of, any person or otherwise voluntarily assume any liability, whether actual or contingent, in respect of any obligation of any other person, except pursuant to the Security Documents or

- issue any further shares (other than to an existing direct or indirect shareholder) or alter any rights attaching to its issued share capital in existence at the date hereof or• save in accordance with the terms of this Agreement and the Security Documents, sell, lease, transfer or otherwise dispose of, by one or more transactions or series of transactions (whether related or not), the whole or any part of its assets or

- incur any indebtedness other than the Project Loan, unless such indebtedness is subordinated in terms of both payment and security to the satisfaction of the Project Lenders to all amounts due under this Agreement or• save in accordance with the terms of this Agreement and the Security Documents, acquire any asset or make any investment or

- amend its constitutional documents or

- change its financial year.

The project sponsors are those companies, agencies or individuals who promote a project, and bring together the various parties and obtain the necessary permits and consents necessary to get the project under way. As has been noted in section 1, often they (or one of their associated companies) are involved in some particular aspect of the project. This might be the construction, operation and maintenance, purchase of the services output from the project or ownership of land related to the project. They are invariably investors in the equity of the project company and may be debt providers or guarantors of specific aspects of the project company’s performance. Some of the different ways in which the sponsors/shareholders invest in a project are explained in section 1.5.

The support provided by project sponsors varies from project to project and includes the giving of comfort letters, cash injection commitments, both pre- and post-completion, as well as the provision of completion support through guarantees and the like. Support is also likely to extend to providing management and technical assistance to the project company. The different types of sponsor support for a project are covered in more detail in section 6.

Third-party equity

These are investors in a project who invest alongside the sponsors. Unlike the sponsors, however, these investors are looking at the project purely in terms of a return on their investments for the benefit of their own shareholders. Apart from providing their equity, the investors generally will not participate in the project in the sense of providing services to the project or being involved in the construction or operating activities.

Third-party investors typically will be looking to invest in a project on a much longer time frame than, say, a typical contractor sponsor, who will in most cases want to sell out once the construction has been completed.

Many third-party investors are development or equity funds set up for the purposes of investing in a wide range of projects and they are starting to become a valuable source of capital for projects. Typically, they will require some involvement at board level to monitor their investment.

[elaborate on premiums]

Banks

The sheer scale of many projects dictates that they cannot be financed by a single lender and, therefore, syndicates of lenders are formed in a great many of the cases for the purpose of financing projects. In a project with an international dimension, the group of lenders may come from a wide variety of countries, perhaps following their customers who are involved in some way in the project. It will almost certainly be the case that there will be banks from the host country participating in the financing. This is as much for the benefit of the foreign lenders as from a desire to be involved on the part of the local lenders. As with the involvement of local sponsors, the foreign lenders will usually take some comfort from the involvement of local lenders.

As is usually the case in large syndicated loans, the project loan will be arranged by a smaller group of arranging banks (which may also underwrite all or a portion of the loan). Often the arranging banks are the original signatories to the loan agreement with the syndication of the loan taking place at a later date. In such cases the arranging banks implicitly take the risk that they will be able to sell down the loan at a later stage.

However, participating in project financings is a very specialised area of international finance and the actual participants tend to be restricted to those banks that have the capability of assessing and measuring project risks. This is not to say that banks not having these skills do not participate in project financings, but for these banks the risks are greater as they must also rely on the judgement of the more experienced banks.

The complexity of most project financings necessitates that the arrangers are large banks with experience in this market, often having dedicated departments of specialists. For the smaller banks with an appetite for this kind of lending, however, there is usually no shortage of opportunities to participate in loans arranged by the larger banks.

Facility agent

As with most syndicated loans, one of the lenders will be appointed facility agent for the purposes of administering the loan on behalf of the syndicate. This role tends to assume an even greater significance in project financings as inevitably there are more administration matters that need undertaking. Usually, however, the role of the facility agent will be limited to administrative and mechanical matters as the facility agent will not want to assume legal liabilities towards the lenders in connection with the project. The documentation will, therefore, establish that the facility agent will act in accordance with the instructions of the appropriate majority (usually 66 2/3 per cent) of the syndicate who will vote and approve the various decisions that need to be taken throughout the life of a project. The documentation, however, may reserve for the facility agent some relatively minor discretions in order to avoid delays for routine consents and approvals.

Technical bank

In many project financings a distinction is drawn between the facility agent (who deals with the more routine day-to-day tasks under the loan agreement) and a bank appointed as technical bank, which will deal with the more technical aspects of the project loan. In such cases it would be the technical bank that would be responsible for preparing (or perhaps reviewing) the banking cases and calculating the cover ratios (see section 8.5 for a more detailed explanation of cover ratios). The technical bank would also be responsible for monitoring the progress of the project generally on behalf of the lenders and liaising with the external independent engineers or technical advisers representing the lenders. It will almost always be the case that the technical bank will be selected for its special ability to understand and evaluate the technical aspects of the project on behalf of the syndicate.

As with the facility agent, the technical bank will be concerned to ensure that it is adequately protected in the documentation and will be seeking to minimise any individual responsibility to the syndicate for its role as technical bank.

Insurance bank/account bank

In some of the larger project financings additional roles are often created for individual lenders, sometimes for no other reason than to give each of the arranging banks a meaningful individual role in the project financing. Two of these additional roles are as insurance bank and as account bank.

The insurance bank, as the title suggests, will be the lender that will undertake the negotiations in connection with the project insurances on behalf of the lenders. It will liaise with an insurance adviser representing the lenders and its job will be to ensure that the project insurances are completed and documented in a satisfactory manner and that the lenders’ interests are observed.

The account bank will be the lender through which all the project cash flows flow. There will usually be a disbursement account to monitor disbursements to the borrower and a proceeds account into which all project receipts will be paid. Frequently, however, there will be a number of other project accounts to deal with specific categories of project receipts (e.g. insurances, liquidated damages, shareholder payments, maintenance reserves, debt service reserves). A more detailed description of the project accounts and their operation is set out in section 8.2.

Multilateral and export credit agencies

Many projects are co-financed by the World Bank or its private sector lending arm, the International Finance Corporation (IFC), or by regional development agencies, for instance the European Bank for Reconstruction and Development (EBRD), the African Development Bank or the Asian Development Bank.

These multilateral agencies are able to enhance the bankability of a project by providing international commercial banks with a degree of protection against a variety of political risks. Such risks include the failure of host governments to make agreed payments or to provide foreign exchange and failure of the host government to grant necessary regulatory approvals or to ensure the performance of certain participants in a project.

Export credit agencies also play a very important role in the financing of infrastructure and other projects in emerging markets. As their name suggests, the role of the agencies is to assist exporters by providing subsidised finance either to the exporter direct or to importers (through buyer credits). Details of the various multilateral agencies and ECAs and a description of the type of financing support they each provide in relation to projects are set out in section 9.

Construction company

In an infrastructure project the contractor will, during the construction period at least, be one of the key project parties. Commonly, it will be employed directly by the project company to design, procure, construct and commission the project facility assuming full responsibility for the on-time completion of the project facilities usually referred to as the “turnkey” model.

The risks associated with the construction phase are discussed in more detail in section 3.4. The contractor will usually be a company well known in its field and with a track record for constructing similar facilities, ideally in the same part of the world. In some large infrastructure projects a consortium of contractors is used. In other cases an international contractor will join forces with a local contractor. In each of these cases one of the issues that will be of concern to both the project company and the lenders is whether the contractors in the joint venture will assume joint and several liability or only several liability under the construction contract. This may be dictated by the legal structure of the joint venture itself (e.g. whether it is an unincorporated association or a true partnership, see section 1.5 for a discussion of the key differences). Lenders, for obvious reasons, will usually prefer joint and several liability.

Although most projects are structured on the basis that there will be one turnkey contractor, some projects are structured on the basis that a number of companies are employed by the project company to carry out various aspects of the design, construction and procurement process which are carried out under the overall project management of either the project company or a project manager. This is not a structure favoured by lenders as it can lead to gaps in responsibilities for design and construction. Lenders will also usually prefer that the project company divests itself of responsibility for project management and that this is assumed by a creditworthy entity against whom recourse may be had if necessary. This is discussed further in section 5.3.

Operator

In most infrastructure projects, where the project vehicle itself is not operating (or maintaining) the project facility, a separate company will be appointed as operator once the project facility has achieved completion. This company will be responsible for ensuring that the day-to-day operation and maintenance of the project is undertaken in accordance with pre-agreed parameters and guidelines. It will usually be a company with experience in facilities management (depending upon the particular project) and may be a company based in the host country. Sometimes one of the sponsors will be the operator as this will often be the principal reason why that sponsor was prepared to invest in the project.

As with the contractor, the lenders will be concerned as to the selection of the operator. They will want to ensure that the operator not only has a strong balance sheet but also has a track record of operating similar types of projects successfully.

The contractor and operator are not usually the same company as very different skills are involved. However, both play a key role in ensuring the success of a project.

Experts

These are the expert consultancies and professional firms appointed by the lenders to advise them on certain technical aspects of the project. (The sponsors will frequently also have their own consultants/professionals to advise them.) The areas where lenders typically seek external specialist advice are on the technical/engineering aspects of projects as well as insurances and environmental matters. Lenders will also frequently turn to advisers to assist them in assessing market/demand risk in connection with the project.

Each of these consultancies/professional firms will be chosen for its expertise in the particular area and will be retained to provide an initial assessment prior to financial close and, thereafter, on a periodic basis. An important point to note is that these consultancies/professional firms are appointed by (and therefore answerable to) the lenders and not the borrower or the sponsors. However, the cost of these consultants/professional firms will be a cost for the project company to assume and this can be a cause of friction. It is usual, therefore, for a fairly detailed work scope to be agreed in advance between the lenders, the expert and the sponsors.

Host government

As the name suggests this is the government in whose country the project is being undertaken. The role of the host government in any particular project will vary from project to project and in some developing countries the host government may be required to enter into a government support agreement (see section 6.7). At a minimum, the host government is likely to be involved in the issuance of consents and permits both at the outset of the project and on a periodic basis throughout the duration of the project. In other cases, the host government (or an agency of the host government) may actually be the purchaser or offtaker of products produced by the project and in some cases a shareholder in the project company (although not usually directly but through government agencies or government controlled companies). It is usually the case that the host government will be expected to play a greater role in project financing (whether in providing support, services or otherwise) in the lesser developed and emerging countries.

Whatever the actual level of involvement the host government of a particular country plays in project financings, its general attitude and approach towards foreign financed projects will be crucial in attracting foreign investment. If there has been any history of less than even-handed treatment of foreign investors or generally of changing the rules, this may act as a serious block on the ability to finance projects in that country on limited recourse terms.

Suppliers

These are the companies that are supplying essential goods and/or services in connection with a particular project. In a power project, for example, the fuel supplier for the project will be one of the key parties. In other projects, a particular supplier may be supplying equipment and/or services required during either the construction or the operating phase of the project. Both the contractor and the operator would also fall under this category. Many of the comments made with respect to the contractor and the operator will also apply to the suppliers. However, it is not always the case that the suppliers (and for that matter the purchasers) are as closely tied into a project structure as, say, the contractor and operator. The lenders may not therefore be in a position to dictate security terms to them to the same extent.

Where there is no long-term supplier of essential goods and/or services to a project, both the lenders and the project company are necessarily taking the risk that those supplies will be available to the project in sufficient amounts and quality, and at reasonable prices.

Purchasers

In many projects where the project’s output is not being sold to the general public, the project company will contract in advance with an identified purchaser to purchase the project’s output on a long-term basis. For example, in a gas project there may be a long-term gas offtake contract with a gas purchaser. Likewise in a power project the purchaser/offtaker may be the national energy authority that has agreed to purchase the power from the plant. However, it is not always the case that there is an agreed offtaker. In some projects (such as oil projects) there will be no pre-agreed long-term offtake contract; rather the products will be sold on the open market and to this extent the banks will take the market risk.

In some projects essential supplies to the project (such as fuel) and the project’s output (e.g. electricity) are purchased by the project company or, as the case may be, sold on “take-or-pay” terms. In other words the purchaser is required to pay for what it has agreed to purchase whether or not it actually takes delivery. This type of contract is discussed in more detail in section 3.4.

Insurers

Insurers play a crucial role in most projects. If there is a major catastrophe or casualty affecting the project then both the sponsors and the lenders will be looking to the insurers to cover them against loss. In a great many cases, if there was no insurance cover on a total loss of a facility then the sponsors and lenders would lose everything. Lenders in particular, therefore, pay close attention not only to the cover provided but also to who is providing that cover. Most lenders will want to see cover provided by large international insurance companies and will be reluctant to accept local insurance companies from emerging market countries.

In some industries (e.g. the oil industry) some of the very large companies have set up their own offshore captive insurance companies, either for their own account or on a syndicate basis with other large companies. This is, in effect, a form of self-insurance and lenders will want to scrutinise such arrangements carefully to ensure that they are not exposed to any hidden risks.

In other cases, insurance cover for particular risks either may not be available or may be available only at prohibitive premiums or from insurers of insufficient substance or repute. In such cases the lenders will want to see that alternative arrangements are made to protect their interests in the event of a major catastrophe or casualty. These and other insurance issues are examined in more detail in section 7.

Other parties

There will be other parties such as financial advisers, rating agencies, local/regional authorities, accountants, lawyers and other professionals that have a role to play in many projects to add to the complexity. Add to this the fact that very often each of these parties will have its own separate legal and tax advisers and it can be seen that the task of legal coordination of these projects can (and frequently is) a difficult, time-consuming and expensive process. This makes effective project management an essential and key part of the success of the implementation of a project (see section 1.7).

Summary of key lenders’ concerns

Before agreeing to lend to a particular project, the lenders will pay specific attention to each of the parties that will have an involvement (however small) in the project, whether at inception, during the construction phase or during the operating phase. It is not an exaggeration to say that, in the case of many project financings, the robustness of the overall project structure is only as strong as its weakest link. The following are some of the key issues that the lenders will focus on:

- The creditworthiness of the parties and, in particular, whether they have sufficient financial resources to meet their obligations under the relevant project documents. If the lenders are not so satisfied, then they are likely to call for guarantees or letters of credit from parent companies or other banks and financial institutions to support these obligations

- Equally important is the ability of the parties to deliver and perform according to the specifications of the project documents. Do the parties have sufficient technical and management resources? Have they experience of similar projects in similar circumstances? Have they undertaken similar arrangements in the relevant country? These are all issues that the lenders will ask themselves before committing to a particular project

- What, if any, relationship does a particular project party have to the project company? As has been noted in this section, it is frequently the case that one of the sponsors will be the contractor, the operator or a major supplier to, or purchaser of output from, the project. In most cases this is likely to be viewed by the lenders favourably; but in some cases the lenders may be concerned to ensure that a proper arm’s-length relationship prevails

- Independence of the project parties, i.e. are they likely to be influenced in any way by local political considerations in such a way as might be detrimental to the lenders? Clearly, foreign parties are less likely to be susceptible to local political or other pressures than local companies and this can sometimes be a concern for lenders

- Continuity, i.e. will a particular project party continue to be involved in the particular project for the duration of the lenders’ involvement? Lenders will usually seek to impose restrictions on the transfer of obligations under project documents by key project parties and where this is not possible then the occurrence of such a transfer might constitute an event of default

- In the case of parties providing technical advice (such as engineers, insurance advisers and lawyers) to the lenders, do they have sufficient professional indemnity insurance cover in place to cover negligent advice? Negligent advice could turn out to be disastrous for the lenders and it would be unfortunate if in those circumstances they had no recourse to the source of such negligent advice

- The lenders will be concerned to ensure that each party that contracts with the project company is duly authorised to enter into contracts with the project company and that its obligations under these contracts constitute its legal, valid, binding and enforceable obligations. To ensure this, the lenders will require legal opinions from lawyers in the home jurisdiction of each such project party. Special attention will often be paid to ensuring the validity and enforceability of the obligations of governments and state authorities or institutions as all too frequently it seems questions arise over their role or participation in projects that are being privately financed

It will be apparent that in many of these instances the concerns of the lenders and the project company/sponsors will be the same, each wants to minimise the risk of external influences or events acting to the detriment of the project.