Difference between revisions of "Project Finance"

Abel Maciel (talk | contribs) (→Operating phase) |

Abel Maciel (talk | contribs) (→Project Financing Documentation) |

||

| (67 intermediate revisions by the same user not shown) | |||

| Line 27: | Line 27: | ||

their revenues.” | their revenues.” | ||

| − | Other more sophisticated definitions are used for special purposes; set out at | + | Other more sophisticated definitions are used for special purposes; set out at the table below. 1 is an example of a definition used in a corporate bond issue. This illustrates the aims of the bondholders, on the one hand, to exclude from the definition any borrowings having a recourse element (since the purpose of the definition was to exclude project finance borrowings from the bond’s cross-default and negative pledge) whilst, on the other hand, the aim of the issuer to catch as wide a range of project-related borrowings. |

| + | |||

| + | ---- | ||

| + | |||

| + | ===Definition of Project Finance Borrowing=== | ||

| + | “Project Finance Borrowing” means any borrowing to finance a project: | ||

| + | |||

| + | *(a) which is made by a single purpose company whose principal assets and business are constituted by that project | ||

| + | and whose liabilities in respect of the borrowing concerned are not directly or indirectly the subject of a | ||

| + | guarantee, indemnity or any other form of assurance, undertaking or support from any member of the [Group] | ||

| + | except as expressly referred to in paragraph (b)(iii) below | ||

| + | *(b) in respect of which the person or persons making such borrowing available to the relevant borrower have no | ||

| + | recourse whatsoever to any member of the [Group] for the repayment of or payment of any sum relating to such | ||

| + | borrowing other than: | ||

| + | **(i) recourse to the borrower for amounts limited to aggregate cash flow or net cash flow from such project | ||

| + | and/or | ||

| + | **(ii) recourse to the borrower for the purpose only of enabling amounts to be claimed in respect of that | ||

| + | borrowing in an enforcement of any security interest given by the borrower over the assets comprised in the | ||

| + | project (or given by any shareholder in the borrower over its shares in the borrower) to secure that borrowing | ||

| + | or any recourse referred to in (iii) below, provided that (A) the extent of such recourse to the borrower is | ||

| + | limited solely to the amount of any recoveries made on any such enforcement, and (B) such person or | ||

| + | persons are not entitled, by virtue of any right or claim arising out of or in connection with such borrowing, | ||

| + | to commence proceedings for the winding-up or dissolution of the borrower or to appoint or procure the | ||

| + | appointment of any receiver, trustee or similar person or official in respect of the borrower or any of its | ||

| + | assets (save for the assets of the subject of such security interest) and/or | ||

| + | *(iii) recourse to such borrower generally, or directly or indirectly to a member of the [Group] under any form of | ||

| + | completion guarantee, assurance or undertaking, which recourse is limited to a claim for damages (other | ||

| + | than liquidated damages and damages required to be calculated in a specified way) for breach of any | ||

| + | obligation (not being a payment obligation or any obligation to procure payment by another or an obligation | ||

| + | to comply or to procure compliance by another with any financial ratios or other tests of financial condition) | ||

| + | by the person against whom such recourse is available or | ||

| + | *(c) which the lender shall have agreed in writing to treat as a project finance borrowing. | ||

| + | |||

| + | ---- | ||

| + | |||

| + | The overriding aim behind this rather complex definition is to make it clear that the repayment of the loan in question is, essentially, limited to the assets of the project being financed. | ||

| + | It should be noted that this Guide does not cover either ship or aircraft financing, although many financings of ships and aircraft are financed on limited recourse terms and could be said to project financings. In many of | ||

| + | these cases the lenders will, directly or indirectly, limit their recourse to the vessel or aircraft itself, its earnings(including requisition compensation) and its insurances. However, the financing of ships and aircraft is a | ||

| + | specialised area and is not within the scope of this Guide. Many of the provisions of this section will, however, apply equally to the financing of ships and aircraft. | ||

| + | |||

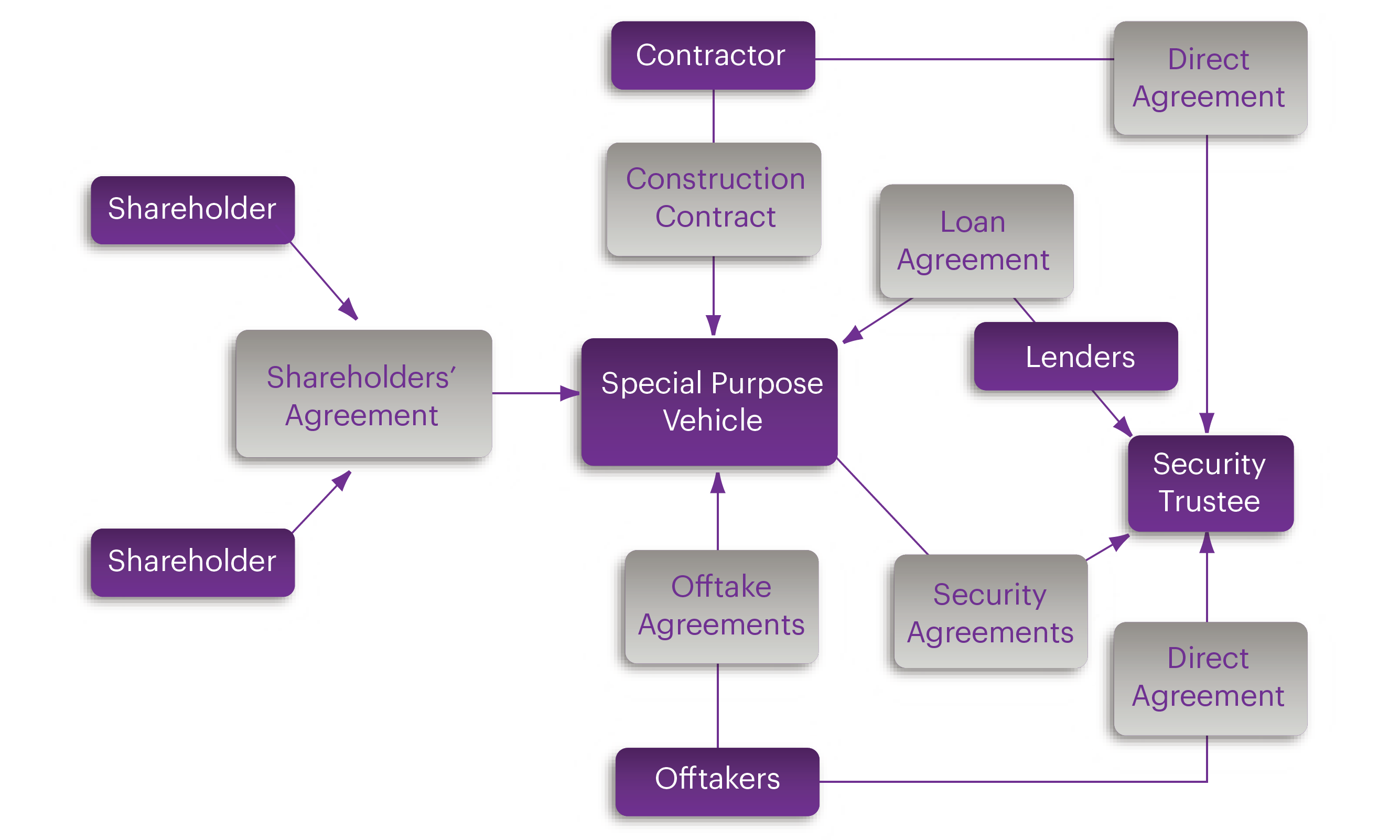

| + | [[File:1-SPV_Structure.PNG|center|800px|SPV Structure]] | ||

==Extent of recourse== | ==Extent of recourse== | ||

| Line 59: | Line 99: | ||

* Where a sponsor is investing in a project with others on a joint venture basis, it can be extremely difficult to agree a risk-sharing basis for investment acceptable to all the co-sponsors. In such a case, investing through a special purpose vehicle on a limited recourse basis can have significant attractions | * Where a sponsor is investing in a project with others on a joint venture basis, it can be extremely difficult to agree a risk-sharing basis for investment acceptable to all the co-sponsors. In such a case, investing through a special purpose vehicle on a limited recourse basis can have significant attractions | ||

| − | [ | + | [[File:2-ProgrammeForProjectFinancing.PNG|center|500px|SPV Structure]] |

* There may be tax advantages (e.g. in the form of tax holidays or other tax concessions) in a particular jurisdiction that make financing a project in a particular way very attractive to the sponsors | * There may be tax advantages (e.g. in the form of tax holidays or other tax concessions) in a particular jurisdiction that make financing a project in a particular way very attractive to the sponsors | ||

| Line 105: | Line 145: | ||

* The appointment of advisers to the project. The two key appointments will be the appointment of financial and legal advisers to the project. However, other advisers, such as technical, insurance, environmental and market risk advisers, may also be required, depending on the circumstances of a particular project | * The appointment of advisers to the project. The two key appointments will be the appointment of financial and legal advisers to the project. However, other advisers, such as technical, insurance, environmental and market risk advisers, may also be required, depending on the circumstances of a particular project | ||

* The capitalisation of the project or project company. How much capital will be put in, when will this be injected and by what method? There is no hard-and-fast rule for determining how much sponsor capital must be injected into a project. Some projects have been structured on the basis that the sponsors have put up only a nominal amount of capital (called “pinpoint capital”). More typically, however, one might expect to see an overall debt/equity ratio in the 90/10 to 75/25, range depending on the dynamics of a particular project. Most lenders will require that sponsor capital is injected at the outset, and before the banks start funding the project company. They may, however, relax this position if they are satisfied as to the credit standing of the sponsors or have received security (such as a bank guarantee or letter of credit) to secure the sponsor’s capital commitment. Shareholder funds are usually injected by way of a subscription for shares of the project company, although there is usually no objection to shareholder loans so long as these are subordinated to the lenders’ loans and are non-interest bearing (or at least the requirement to pay interest is suspended until dividends are permitted to be paid (see below)) | * The capitalisation of the project or project company. How much capital will be put in, when will this be injected and by what method? There is no hard-and-fast rule for determining how much sponsor capital must be injected into a project. Some projects have been structured on the basis that the sponsors have put up only a nominal amount of capital (called “pinpoint capital”). More typically, however, one might expect to see an overall debt/equity ratio in the 90/10 to 75/25, range depending on the dynamics of a particular project. Most lenders will require that sponsor capital is injected at the outset, and before the banks start funding the project company. They may, however, relax this position if they are satisfied as to the credit standing of the sponsors or have received security (such as a bank guarantee or letter of credit) to secure the sponsor’s capital commitment. Shareholder funds are usually injected by way of a subscription for shares of the project company, although there is usually no objection to shareholder loans so long as these are subordinated to the lenders’ loans and are non-interest bearing (or at least the requirement to pay interest is suspended until dividends are permitted to be paid (see below)) | ||

| + | |||

* The dividend/distribution policy of the sponsors. This will frequently be a source of much debate with the project lenders. On the one hand, most sponsors will be keen to extract profits at an early stage. The project lenders, however, will not be keen to see the sponsors taking out profits until the project has established and proved itself and the project lenders have been repaid at least some of their loans. It would be unusual for the project lenders to permit the payment of dividends (or the payment of interest on subordinated loans) prior to the date of the first repayment of the project loan and then only if the key project cover ratios will be satisfied after the payment of the dividends (see section 8.5 for an explanation of key cover ratios) | * The dividend/distribution policy of the sponsors. This will frequently be a source of much debate with the project lenders. On the one hand, most sponsors will be keen to extract profits at an early stage. The project lenders, however, will not be keen to see the sponsors taking out profits until the project has established and proved itself and the project lenders have been repaid at least some of their loans. It would be unusual for the project lenders to permit the payment of dividends (or the payment of interest on subordinated loans) prior to the date of the first repayment of the project loan and then only if the key project cover ratios will be satisfied after the payment of the dividends (see section 8.5 for an explanation of key cover ratios) | ||

* Management of the project vehicle. Who will undertake this and how? Will the project vehicle have its own employees and management or will these be supplied by one or more of the sponsors? If one or more of the sponsors is to supply management and/or technical assistance to the project company, then the lenders will expect to see this arrangement formalised in an agreement between the sponsor in question and the project company | * Management of the project vehicle. Who will undertake this and how? Will the project vehicle have its own employees and management or will these be supplied by one or more of the sponsors? If one or more of the sponsors is to supply management and/or technical assistance to the project company, then the lenders will expect to see this arrangement formalised in an agreement between the sponsor in question and the project company | ||

* Sale of shares and pre-emption rights. This will be of concern to sponsors and lenders alike. In particular, the lenders will want the comfort of knowing that the sponsor group that has persuaded them to lend to the project company in the first place will continue to be in place until the loans have been repaid in full. | * Sale of shares and pre-emption rights. This will be of concern to sponsors and lenders alike. In particular, the lenders will want the comfort of knowing that the sponsor group that has persuaded them to lend to the project company in the first place will continue to be in place until the loans have been repaid in full. | ||

| + | |||

| + | ---- | ||

==Project implementation and management== | ==Project implementation and management== | ||

| Line 114: | Line 157: | ||

With so many parties involved having conflicting interests, the issue of effective project management assumes great significance in most project financings. It does not matter whether the overall responsibility is assumed by the sponsors (and their advisers) or by the lenders (and their advisers). What is crucial, however, is that one of the influential parties assumes overall control for managing the project from its inception to financial close. Without effective project management, a project can very easily go off the rails, with each of the parties singularly concentrating on issues and documents that are relevant to it. Because of the need to understand all aspects of the project with a view to assessing the overall risk profile, it is often the lenders (and their advisers) who are in the best position to manage effectively and steer a project to financial close. | With so many parties involved having conflicting interests, the issue of effective project management assumes great significance in most project financings. It does not matter whether the overall responsibility is assumed by the sponsors (and their advisers) or by the lenders (and their advisers). What is crucial, however, is that one of the influential parties assumes overall control for managing the project from its inception to financial close. Without effective project management, a project can very easily go off the rails, with each of the parties singularly concentrating on issues and documents that are relevant to it. Because of the need to understand all aspects of the project with a view to assessing the overall risk profile, it is often the lenders (and their advisers) who are in the best position to manage effectively and steer a project to financial close. | ||

| − | =Parties to | + | =[[Parties to a Project Financing]]= |

| − | + | One of the complicating (and interesting) features of most projects is the considerable number of [[Parties to a Project Financing | parties]] with differing interests that are brought together with the common aim of being involved to a greater or lesser extent with a successful project. It is one of the challenges of those involved with a project to ensure that all of these parties can work together efficiently and successfully and cooperate in achieving the project’s overall targets. It is inevitably the case that, although all of the parties will share the same overall aim in ensuring that the project is successful, their individual interests will vary considerably and, in many cases, will conflict. With many projects, there will be an international aspect which will involve different project parties located in different jurisdictions and there will often be tensions between laws and practices differing from one country to another. | |

| − | |||

| − | One of the complicating (and interesting) features of most projects is the considerable number of parties with differing interests that are brought together with the common aim of being involved to a greater or lesser extent with a successful project. It is one of the challenges of those involved with a project to ensure that all of these parties can work together efficiently and successfully and cooperate in achieving the project’s overall targets. It is inevitably the case that, although all of the parties will share the same overall aim in ensuring that the project is successful, their individual interests will vary considerably and, in many cases, will conflict. With many projects, there will be an international aspect which will involve different project parties located in different jurisdictions and there will often be tensions between laws and practices differing from one country to another | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | =[[Project Financing Documentation]]= | |

| − | + | The essence of project financing is the apportionment of the project and other risks amongst the various parties having an interest in that project. The way in which this risk allocation is implemented is, essentially, through the complex matrix of contractual relations between the various project parties as enshrined in the [[Project Financing Documentation | documentation]] entered into between them. There is no general body of law in England (or elsewhere) that dictates how projects must be structured or how the risks should be shared amongst the project parties. Rather, each project must fit within the legal and regulatory framework in the various jurisdictions in which it is being undertaken or implemented. Accordingly, the contracts between the various project parties assume a huge significance and it is these documents that are the instruments by which many of the project risks are shared amongst the project parties. | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | The essence of project financing is the apportionment of project and other risks amongst the various parties having an interest in that project. The way in which this risk allocation is implemented is, essentially, through the complex matrix of contractual relations between the various project parties as enshrined in the documentation entered into between them. There is no general body of law in England (or elsewhere) that dictates how projects must be structured or how the risks should be shared amongst the project parties. Rather, each project must fit within the legal and regulatory framework in the various jurisdictions in which it is being undertaken or implemented. Accordingly, the contracts between the various project parties assume a huge significance and it is these documents that are the instruments by which many of the project risks are shared amongst the project parties. | ||

As will be apparent, there is no such thing as a standard set of project documents. Each project will have its own set of documents specially crafted for that particular project. Set out below is a brief description of some of the key documents found in many project financing structures. | As will be apparent, there is no such thing as a standard set of project documents. Each project will have its own set of documents specially crafted for that particular project. Set out below is a brief description of some of the key documents found in many project financing structures. | ||

These documents can conveniently be grouped as follows: | These documents can conveniently be grouped as follows: | ||

| Line 259: | Line 168: | ||

* Loan and security documents | * Loan and security documents | ||

* Project documents. | * Project documents. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=Project Structures= | =Project Structures= | ||

| Line 509: | Line 187: | ||

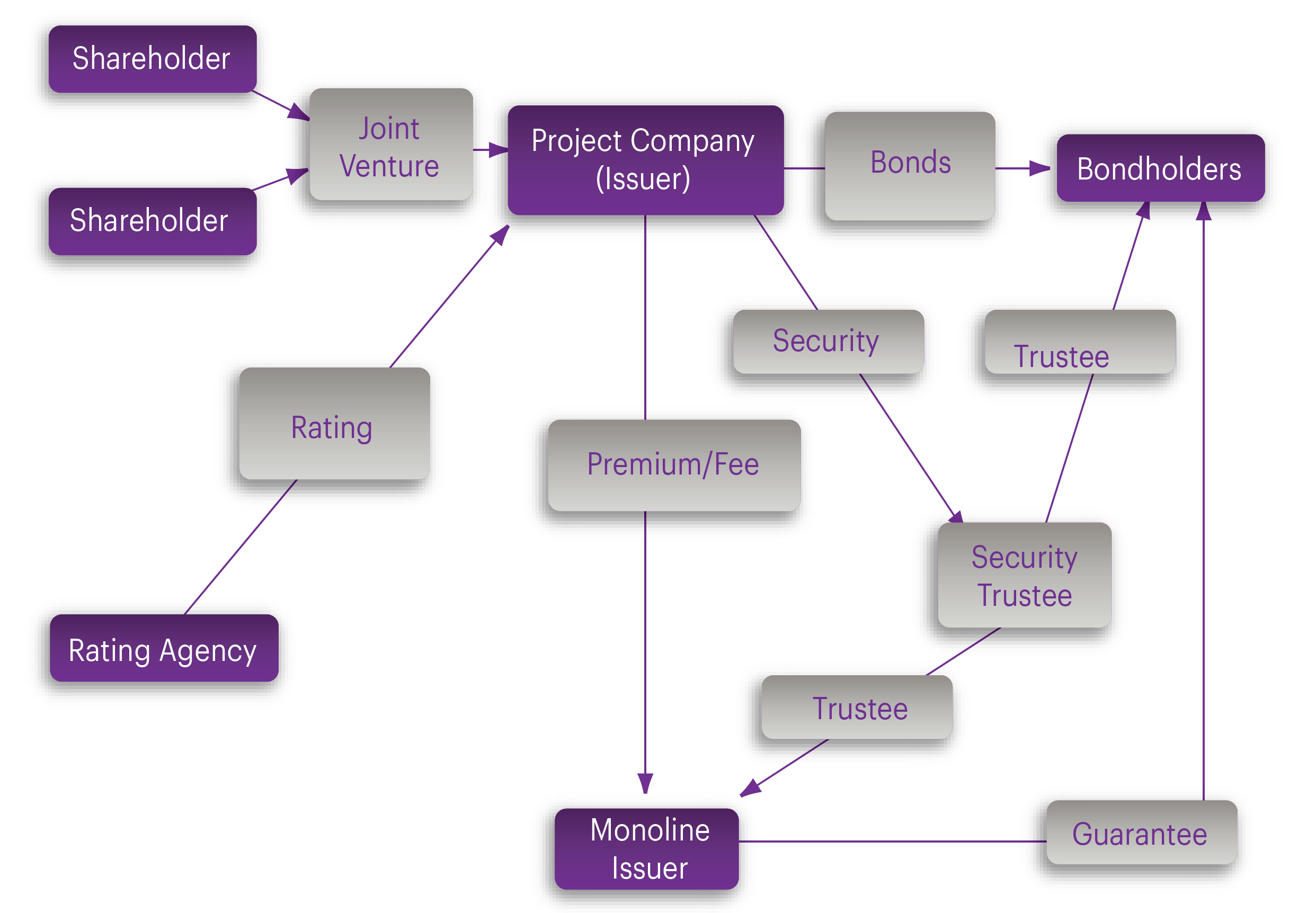

An example of a bond structure for a project is set out below. | An example of a bond structure for a project is set out below. | ||

| − | [ | + | [[File:5-ProjectFinancing_BondStructure.PNG|center|800px|SPV Structure]] |

==Leasing== | ==Leasing== | ||

| Line 573: | Line 251: | ||

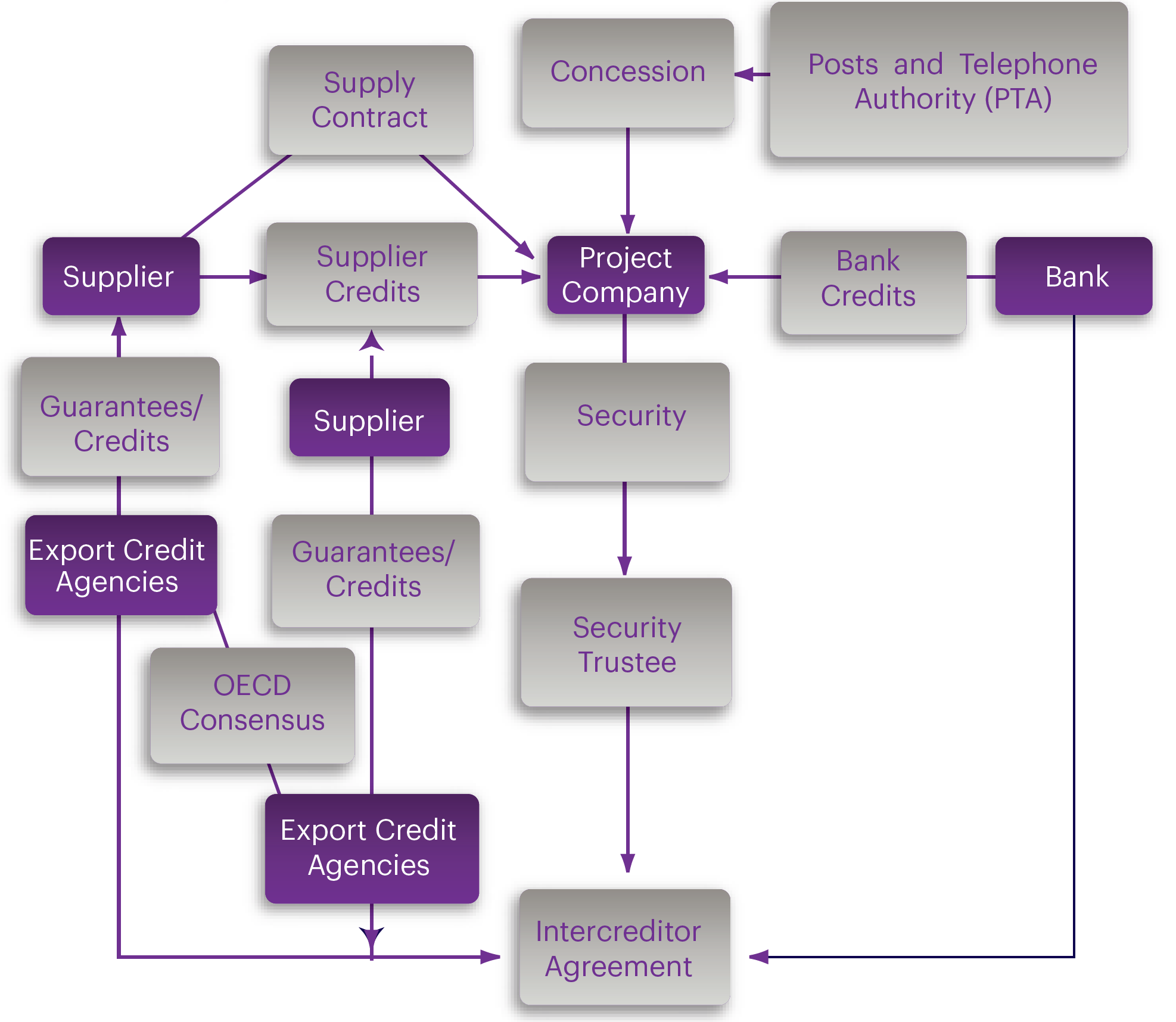

Under the concession agreements, the project company will usually own and operate the project for the duration of the concession. The revenue produced by the project will be used by the project company to repay the project loans, operate the concession and recover the investment of the sponsors plus a profit margin. Overall, the structure is similar to many other project financings in that the project loans will usually be provided direct to the project company (which is likely to be a subsidiary of the sponsors based in the host country) and the lenders will take security over (principally) the project company’s rights under the concession agreement together with any other available project assets. | Under the concession agreements, the project company will usually own and operate the project for the duration of the concession. The revenue produced by the project will be used by the project company to repay the project loans, operate the concession and recover the investment of the sponsors plus a profit margin. Overall, the structure is similar to many other project financings in that the project loans will usually be provided direct to the project company (which is likely to be a subsidiary of the sponsors based in the host country) and the lenders will take security over (principally) the project company’s rights under the concession agreement together with any other available project assets. | ||

| − | The principal terms of a concession agreement for a typical BOT project are set out in | + | The principal terms of a concession agreement for a typical BOT project are set out in Principal Terms of a Concession Agreement below: |

| − | + | ---- | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

===Principal Terms of a Concession Agreement=== | ===Principal Terms of a Concession Agreement=== | ||

====Concession grantor’s obligations==== | ====Concession grantor’s obligations==== | ||

| Line 603: | Line 275: | ||

* To train the concession grantor’s staff of the concession grantor prior to re-transfer | * To train the concession grantor’s staff of the concession grantor prior to re-transfer | ||

* (Possibly) to transfer the project assets to the concession grantor at the expiration of the concession. | * (Possibly) to transfer the project assets to the concession grantor at the expiration of the concession. | ||

| + | ---- | ||

| + | |||

| + | Where the concession is in respect of a public transport facility, the concession may well provide for control of the level of charges, permitted adjustments and the duration of the period when charges can be levied. In return for any restrictions on charges, the concession grantor may agree to pay a subsidy or guarantee a minimum level of demand. | ||

| + | |||

| + | In the event of a default by the project company of any of the terms of the concession, or the occurrence of some other event which makes it unlikely that the project will be completed, the concession grantor will wish to have the ability to terminate the concession and/or take over the project company in order to complete the project itself. Of course, the project lenders will be concerned about any rights which the concession grantor has to terminate the concession agreement or to alter any of the terms of the concession agreement in a way that is likely to impact on their financing arrangements. They are also likely to want the ability to step in themselves and take over the project company’s rights under the concession agreement in certain circumstances (see section 6.6 for a further description of step in procedures and direct agreements). | ||

| + | |||

| + | An example of a BOT model for a telecommunications project is set out can be seen below. | ||

| + | |||

| + | [[File:6-Structure_For_A_BOT_Telecommunications.PNG|center|800px|SPV Structure]] | ||

==Forward Purchase model== | ==Forward Purchase model== | ||

| Line 619: | Line 300: | ||

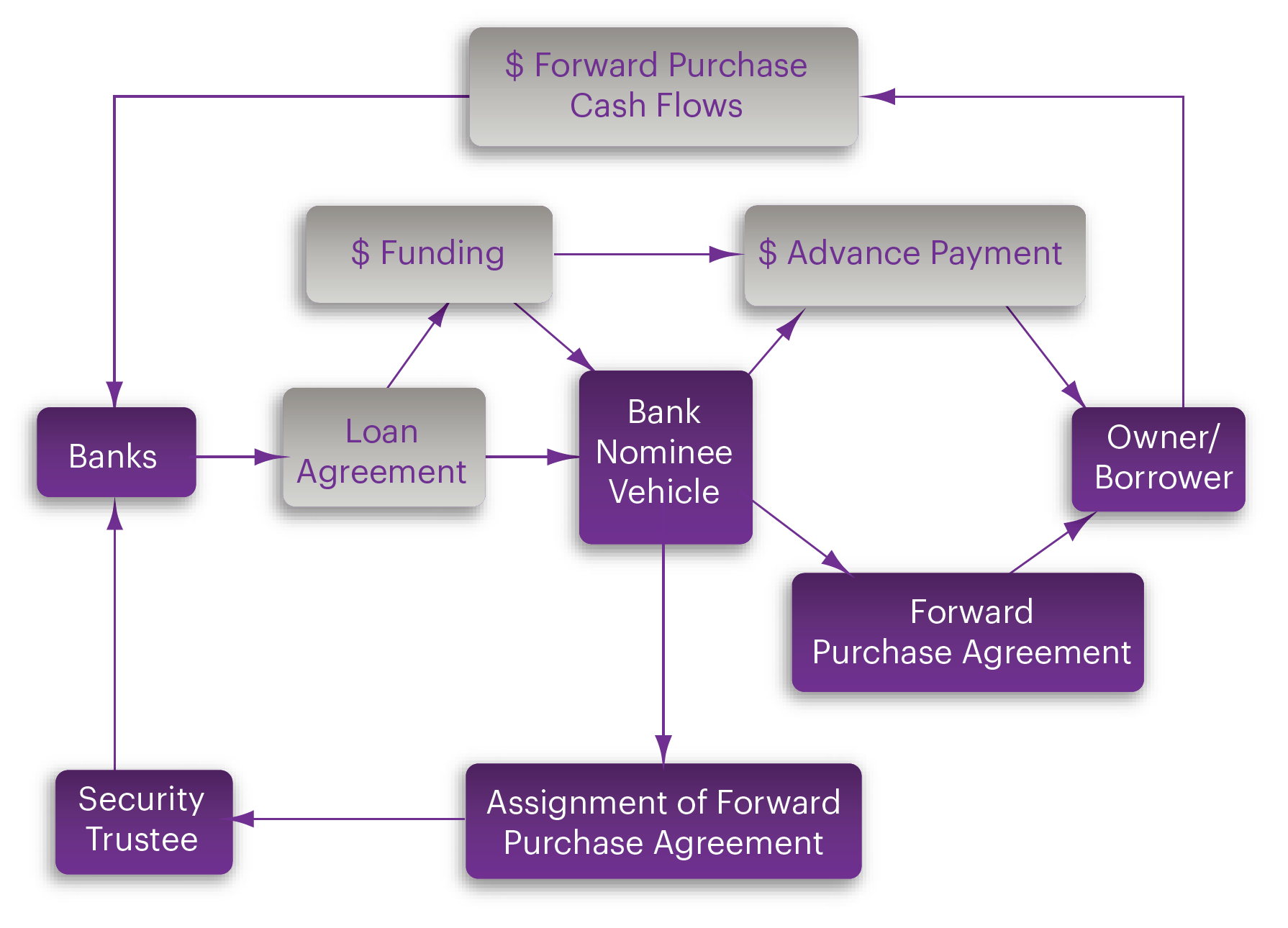

An example of a forward purchase structure is set out in the image below. | An example of a forward purchase structure is set out in the image below. | ||

| − | [ | + | [[File:7-PF_StructureForAForwardPurchaseTransaction.PNG|center|800px|SPV Structure]] |

=Sharing of Risks= | =Sharing of Risks= | ||

| Line 648: | Line 329: | ||

* Price: lenders have a clear preference for fixed-price lump sum contracts. They will wish to be confident that the facility can be completed within the funding which has been committed and that cost overruns are the responsibility of the contractor. If there are to be any changes to the contract price, then the lenders will want to have a say on this particularly if this is as a result of changes to specifications on the part of the project company | * Price: lenders have a clear preference for fixed-price lump sum contracts. They will wish to be confident that the facility can be completed within the funding which has been committed and that cost overruns are the responsibility of the contractor. If there are to be any changes to the contract price, then the lenders will want to have a say on this particularly if this is as a result of changes to specifications on the part of the project company | ||

| − | [ | + | [[File:8-PF_ProjectRiskGroups.PNG|center|800px|SPV Structure]] |

'''* Completion:''' The lenders will want to ensure that there is a fixed date for completion with minimum ground entitling the contractor to extend the completion date. If there are any delays, then the lenders will want to see liquidated damages in an amount sufficient to cover the project company’s costs of servicing the loans and operating costs during the period of the delay. In practice, however, it is seldom possible to obtain full coverage in terms of liquidated damages for an unlimited period. What is generally negotiated is a fixed per diem amount subject to a cap. Under English law, a distinction is drawn between liquidated damages, which are a genuine pre-estimate of the damage likely to result from the breach of contract (failure to complete on time) and which are enforceable, and clauses which penalise the contractor unfairly and are unenforceable. A provision will generally be considered to be a penalty if the amount payable under the contract is extravagant and unconscionable compared with the greatest loss that could (at the time the contract was entered into) be conceived to flow from the breach. The wording used in the contract will be irrelevant; it is the substance of the clause which will be taken into consideration. One factor which may distinguish the contract provision as a penalty is if compensation is by way of a single lump sum which is payable on the occurrence of several events some of which would give rise to trivial damages, others of which would give rise to substantial damages. The lenders should, therefore, make sure that the liquidated damages are set at a carefully calculated and realistic rate in order to satisfy themselves that the provisions are enforceable. | '''* Completion:''' The lenders will want to ensure that there is a fixed date for completion with minimum ground entitling the contractor to extend the completion date. If there are any delays, then the lenders will want to see liquidated damages in an amount sufficient to cover the project company’s costs of servicing the loans and operating costs during the period of the delay. In practice, however, it is seldom possible to obtain full coverage in terms of liquidated damages for an unlimited period. What is generally negotiated is a fixed per diem amount subject to a cap. Under English law, a distinction is drawn between liquidated damages, which are a genuine pre-estimate of the damage likely to result from the breach of contract (failure to complete on time) and which are enforceable, and clauses which penalise the contractor unfairly and are unenforceable. A provision will generally be considered to be a penalty if the amount payable under the contract is extravagant and unconscionable compared with the greatest loss that could (at the time the contract was entered into) be conceived to flow from the breach. The wording used in the contract will be irrelevant; it is the substance of the clause which will be taken into consideration. One factor which may distinguish the contract provision as a penalty is if compensation is by way of a single lump sum which is payable on the occurrence of several events some of which would give rise to trivial damages, others of which would give rise to substantial damages. The lenders should, therefore, make sure that the liquidated damages are set at a carefully calculated and realistic rate in order to satisfy themselves that the provisions are enforceable. | ||

| Line 970: | Line 651: | ||

==Protection for lenders== | ==Protection for lenders== | ||

| + | In order to cover themselves effectively against as many of the risks mentioned in section 7.4 as possible, the lenders will look to take the following action: | ||

| + | ===Insurance Advisers=== | ||

| + | In most large projects the lenders will appoint a firm of internationally recognised insurance brokers to act for them in providing specialist advice on the scope and level of insurances applicable for the project. A detailed insurances memorandum will be entered into between the lenders and the project company (or whoever is responsible for undertaking the insurances for the project) which will spell out the minimum insurance obligations at all stages of the project. | ||

| + | ===Security Assignment=== | ||

| + | As part of the security package, the lenders would expect to receive an assignment by way of security of all the rights, title and interest of the borrower in all project insurances, or, where the insurances are arranged by the contractor or another party, then a security assignment from this party. Notice of this assignment will be given to the insurers in the usual manner. | ||

| + | ===Loss Payable Clauses=== | ||

| + | A “loss payable” clause will be endorsed in to each of the policies. This clause will stipulate that the proceeds of any claim (usually above a certain minimum threshold) are to be paid to (or to the order of) the lenders. Because of the uncertainty as to the exact legal characterisation of loss payable clauses they are rarely relied upon without a formal security assignment. | ||

| + | ===Co-insurance=== | ||

| + | It is possible under English law to insure in the names of both the project company and the lenders or alternatively to note the lenders as co-assured on the policy. This has the advantage that protection for some of the previously mentioned risks falls away. For example, if there has been a breach of warranty by the project company, it is unlikely that the lenders will be aware of such breach. In these circumstances the insurers should have no grounds to resist a lender’s claim in these circumstances. Because the lenders’ insurable interest is expressed as a separate interest to that of the project company, it is thought that under English common law principles a policy should not be tainted with any non-disclosure or misrepresentation by the project company with respect to the policy. However, where so much may turn on the policy validity, most lenders are reluctant to rely on simply the common law, since it could always be argued that where only one party arranges the insurances that party is in effect acting as agent for the other party and that, accordingly, each party is affected by non-disclosure or misrepresentation. It is therefore safer to combine a co-insurance provision with an express endorsement on the policy whereby the insurer acknowledges that non-disclosure or misrepresentation by one party should not affect the other. | ||

| + | |||

==Broker’s undertaking== | ==Broker’s undertaking== | ||

| + | This is an undertaking delivered by the broker (of the project company) to the lenders regarding the insurances and forms an essential part of the overall security package for lenders. The terms are a matter of negotiation between the broker and the lenders; however, standard forms have been produced for these undertakings in the market. Typically, the following undertakings would be asked of the brokers: | ||

| + | * To have endorsed on each and every insurance policy agreed endorsements together with a copy of the notice(s) of assignment to the insurer signed by an authorised signatory of the project company and acknowledged by the insurers | ||

| + | * To pay to the facility agent without any set-off or deduction of any kind for any reason any and all proceeds from the insurances received by them from the insurers (except as might be otherwise permitted in the relevant loss payable and notice of cancellation clauses) | ||

| + | * To advise the facility agent: | ||

| + | **(a) at least 30 days (or such lesser period, if any, as may be specified from time to time in the case of war risks and kindred perils) before | ||

| + | ***(1) cancellation of any of the insurances is to take effect and | ||

| + | ***(2) any alteration to termination or expiry of any of the insurances is to take effect | ||

| + | **(b) of any default in the payment of any premium for any of the insurances prior to any cancellation or lapse of cover which may then arise | ||

| + | **(c) at least 30 days prior to the expiry of the insurances if they have not received renewal instructions from the project company and/or any jointly insured parties or the agents of any such party, and, if they receive instructions to renew, to advise the facility agent as soon as reasonably practicable of the details thereof | ||

| + | **(d) of any act or omission or of any event of which they have knowledge and which might invalidate or render unenforceable in whole or in part any of the insurances as soon as reasonably practicable on becoming aware of the same | ||

| + | * To disclose to the insurers any fact, change of circumstance or occurrence material to the risks insured against under the insurance promptly upon becoming aware of such fact, change of circumstance or occurrence | ||

| + | * To treat as confidential all information marked as or otherwise stated to be confidential and supplied to them by any person for the purposes of disclosure to the insurers under the insurances and not to disclose, without the written consent of that person, such information to any third party other than the insurers under the insurances in satisfaction of their undertaking in the previous paragraph | ||

| + | * To hold the insurance slips or contracts, the policies and any renewals thereof or any new or substitute policies (in the case of new or substitute policies, issued only with the facility agent’s consent), to the order of the facility agent | ||

| + | * To notify the facility agent at least 30 days or such lesser period as shall be practicable prior to ceasing to act as brokers to the project company or, if impracticable, promptly following their ceasing so to act | ||

| + | * To use all reasonable endeavours to ensure that, if any of the insurances are on a claims made basis, such policies of such insurances are endorsed to provide cover for at least eight years after the expiry or cancellation of such policies or that alternative arrangements are made in order to achieve an equivalent result. | ||

| + | |||

==Reinsurance== | ==Reinsurance== | ||

| + | It is often the case that all or a significant part of an insurance policy is reinsured with other insurers. Usually this is simply because the principal insurer does not have the capacity to absorb the full risk insured against. It is also the case that some jurisdictions have a legal requirement that all or a part of the insurances is insured through domestic insurers. With many of the larger projects this will frequently pose a problem for the local insurers who will not be able to underwrite the full amount required. Also, the lenders may have a concern with all the insurances being placed locally as this exposes them potentially to additional risks that the payment of insurance claims may be blocked or otherwise interfered with (i.e. a form of political risk). | ||

| + | |||

| + | Reinsurance with offshore insurers is therefore frequently called for by both lenders and local insurers. However, there is a serious security issue for lenders to consider with reinsurance. The issue concerns the possible insolvency of the principal insurer. Since the contract of reinsurance will have been taken out by the principal insurer with the reinsurance company, should the principal insurer become insolvent, all proceeds payable under a reinsurance contract will be paid to the estate of the principal insurer and distributed to its creditors according to the normal bankruptcy laws in its jurisdiction of incorporation. In other words, neither the project company nor the lenders are likely to have any priority interest in these insurance monies since they form part of the insurer’s bankruptcy estate. | ||

| + | |||

| + | There are two possible ways of dealing with this issue: | ||

| + | * The most satisfactory route is to require the principal insurer to execute an assignment of the reinsurance proceeds in favour of the project company thereby removing the reinsurance proceeds from the principal insurer’s bankruptcy estate. Notice of assignment would be served on the reinsurer in the normal way and the reinsurance proceeds would be paid direct to the project company (or, more likely, the security trustee). Although this is the best protection for the project company and the lenders, it is relatively rare that an insurance company can be persuaded to create a security assignment in these terms | ||

| + | * The alternative, and less satisfactory approach, is to arrange for the reinsurance contract to have endorsed on it a “cut-through” undertaking. The effect of this undertaking is that the reinsurer would be irrevocably directed by the principal insurer to pay the proceeds of all claims direct to the project company (or, more likely, the security trustee) thereby passing by (or cutting through) the principal insurer. The problem with this approach, however, is that it is doubtful that such an undertaking would be enforceable against a liquidator of the principal insurer as it does not amount to a security interest but is simply an unsecured payment direction. | ||

=The Project Loan Agreement= | =The Project Loan Agreement= | ||

| + | In most project financings the loan agreement is likely to be the key financing document. Almost certainly structured on a syndicated basis, there will be a number of key points for discussion between the parties. The following are points that are likely to arise in most project financings and will be important issues for both the lenders and the project company. | ||

| + | |||

==Warranties, covenants and events of default== | ==Warranties, covenants and events of default== | ||

| + | In a project financing the scope of the warranties, covenants and events of default will be expanded to cover the project, the project agreements, the security agreements and (usually) other major project parties. Although it has already been noted that the remedies available to the lenders following a default may well be limited, the usual approach is for the lenders to demand extensive protection through warranties, covenants and events of default. This is more to do with a desire to be able to control matters should defaults occur than a desire to be able to accelerate and enforce their security for a seemingly minor default. That said, there is always a danger that if the warranties, covenants and events of default are too tightly drawn, minor delays or hiccups in the project can trigger a default which may necessitate syndicate meetings, waivers and unnecessary (and expensive) aggravation to all concerned. There is a balance, therefore, to be struck between on the one hand giving the lenders a sufficient comfort level so that, should things start to go seriously amiss with the project, they have the tools to take control (or at least to start issuing orders) whilst on the other hand avoiding the occurrence of default for minor and insignificant hiccups. An example of typical covenants and events of default for an infrastructure project is set out in the table below. | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |+Project Undertakings and Events of Default | ||

| + | |- | ||

| + | |'''Undertakings''' | ||

| + | |'''Events of Default''' | ||

| + | |- | ||

| + | |Usual for this type of financing, but including: | ||

| + | |Usual for this type of financing, but including: | ||

| + | |- | ||

| + | | | ||

| + | ** To carry out the Project in accordance with good industry practice• To comply with all of the provisions of the Project Documents | ||

| + | ** Not to amend or waive any provision of the Project Documents without the Majority Banks’ consent | ||

| + | ** Not to exercise certain specified discretions in the Project Documents without the consent of the Majority Banks and to exercise certain specified discretions in the Project Documents if the Majority Banks so require | ||

| + | ** Not to enter into any new material agreement without the Majority Banks’ consent | ||

| + | ** Not to agree to the issue of the Takeover/Acceptance Certificate under the Construction Contract without the consent of the Independent Engineers• To use best endeavours to ensure that the Project Completion Date occurs as soon as possible and in any event by [ ] | ||

| + | ** Negative pledge | ||

| + | ** Non-disposal of assets | ||

| + | ** No other borrowings or lendings | ||

| + | ** Not to make any distributions/dividends | ||

| + | ** Take out agreed insurances with insurers and on terms acceptable to the Insurance Adviser | ||

| + | ** Comply with all applicable laws (including environmental laws) | ||

| + | ** Provide the Independent Engineer with access to the Project Facilities. | ||

| + | | | ||

| + | ** Failure to pay any amount due under any Finance Document | ||

| + | ** Failure to comply with any other undertaking under any Finance Document or Project Document | ||

| + | ** Breach of any representation and warranty contained in any Finance Document | ||

| + | ** Remaining Development Costs exceed Available Funding | ||

| + | ** Loan Life Cover Ratio falls below [ ]:1 or Project Life Cover Ratio falls below [ ]:1 | ||

| + | ** Any insurance in relation to the Project becomes voidable (whether for lack of disclosure, breach of a condition or otherwise) or is cancelled | ||

| + | ** Revocation of, or alteration of the terms of, any consent or licence required in connection with the Project | ||

| + | ** Damage to all or any material part of the Project Assets | ||

| + | ** Abandonment of the Project | ||

| + | ** Force majeure continues for more than [ ] consecutive days (or for more than [ ] days in any year) under any Project Document | ||

| + | ** Nationalisation or expropriation of all or a material part of the Project | ||

| + | ** Force majeure continues for more than [ ] consecutive days (or for more than [ ] days in any year) under any Project Document | ||

| + | ** Nationalisation or expropriation of all or a material part of the Project | ||

| + | ** The Independent Engineer certifies that, in his opinion, the Project Completion Date is unlikely to occur by [ ], or the Project Completion Date does not occur by[ ] | ||

| + | ** Cross-default on the Borrower, Completion Guarantor or any Major Project Party• Insolvency of, or insolvency or similar proceedings affecting, the Borrower, Completion Guarantor or any Major Project Party• Change in control of the Borrower, the Completion Guarantor or any Major Project Party | ||

| + | ** Any party to a Project Document serves a termination notice under such Project Document or a Project Document is terminated. | ||

| + | |} | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | There is a very important point to bear in mind when drafting warranties, covenants and events of default which relates to the recourse to the project company. It has already been noted that in most project financings recourse will be limited to the project assets and its cash flows. Where the project company is not a single purpose vehicle and therefore has other assets over and above the relevant project or where the shareholders/sponsors have agreed to procure performance of the project company’s covenants under the project loan agreement (except for the obligation to make payments of the project loan), it will be crucial for the project company and the shareholders/sponsors whether an event or circumstance is treated as a warranty, as a covenant or as an event of default. The reason is that, whilst the lenders will usually agree to limit their recourse on an enforcement to the project assets and its cash flows, they will usually not forgo any other remedies (such as a claim in damages) that they may have in law against the project company and/or the shareholders/sponsors for breach of warranties and/or covenants. | ||

| + | |||

| + | This, therefore, provides the lenders with a potential damages claim against the project company and/or the shareholders/sponsors although, as has been noted above (see section 1.3) a damages claim is not the same as a claim for a recovery of a debt. Nevertheless, it is a valuable right and one which many lenders will not want to give up. On the other hand, the mere occurrence of an event of default is simply a trigger entitling the lenders to accelerate the project loan and enforce their security. It does not entitle the lenders to a damages claim. | ||

| + | |||

| + | Borrowers and shareholders/sponsors will therefore prefer events to be treated as events of default whereas lenders will prefer to characterise events as warranties and/or covenants. | ||

| + | |||

| + | An illustration of this point will help. In a concession-based financing one would expect to see a warranty in the project loan agreement at the outset stating that the concession is in full force and effect. However, one would not expect to see this repeated as the termination of the concession may well be something that is beyond the control of the project company. The project company will not want to warrant something over which it potentially has no control. On the other hand, however, the lenders will require a covenant that the project company performs its obligations in accordance with the terms of the concession and does nothing itself to precipitate a termination of the concession. This is perfectly reasonable from the point of view of the lenders since these are events within the control of the project company. Finally, the lenders will expect there to be an event of default should the concession be terminated for any reason. Structured in this manner, the borrower will be satisfied that a potential damages claim against it will only arise in circumstances where it has breached an obligation and the lenders will be protected in any event should the concession be terminated. Essentially, the distinction is one of fault versus no fault. If the event or circumstance is the fault of the project company, then the lenders will expect protection through warranties and covenants. If, on the other hand, an event or circumstance is not the direct fault of the project company (e.g. expropriation or nationalisation of its assets or termination of the concession other than as a consequence of a breach by the project company), then the project company would not expect there to be any recourse against its non-project assets although, of course, the lenders will need to have the right to accelerate the project loan in these circumstances. | ||

| + | |||

| + | As noted earlier, this distinction is only really of significance where the project company is not a special purpose vehicle and therefore has assets other than the project in question which the lenders may seek to attach or appropriate in satisfaction of the project loan. It will also be of significance where the sponsors/shareholders have agreed with the lenders to procure performance of the project company’s covenants. Where the project company has no assets apart from the project, then a claim in damages will give the lenders little comfort or recourse over and above that which it already has against the project company. | ||

| + | |||

==Project bank accounts== | ==Project bank accounts== | ||

| + | It has already been noted that one of the key features of project loan documentation will be the requirement that the project lenders control all the project cash flows. This control is usually implemented through the requirement that the borrower (and other relevant project parties) open a number of bank accounts with either the facility agent or another bank (the project accounts bank). These bank accounts will, of course, be charged in favour of the lenders as part of the overall security package. | ||

| + | |||

| + | At the very minimum there will be two such accounts. One account, the disbursement account, will be used in connection with drawdowns. All drawdowns under the project loan will be paid into the disbursement account and the project company will be permitted to withdraw sums from the disbursement (or drawdown) account, say, once a month against appropriate evidence that the payment in question was due. In the case of large items (e.g. payments to suppliers or contractors) the account bank may be authorised to make the payment direct to the payee on behalf of the project company. This is to give the lenders an additional layer of comfort that monies will not go astray. The second account, the proceeds (or project receipts) account, will be the account to which all sums payable to the project company in connection with the project will be credited. These payments might include sales proceeds, insurance receipts, liquidated damages payable under the project documents to the project company, sponsor payments etc. The project company will be entitled to withdraw from the proceeds account sums necessary to meet its operating costs, taxes, debt service, other payments that it is required to make in connection with the project and, perhaps, dividends or other distributions to shareholders. Often, the proceeds account is split into a number of different accounts for different categories of receipts where different conditions are to apply to different categories of receipts. For example, insurance receipts may or may not be payable to the project company depending upon what type of claim they relate to. | ||

| + | |||

| + | These accounts will usually be interest bearing and sometimes where there is a likelihood that sums will remain deposited in these accounts for longer periods, provision will be made for the investment of balances into low-risk investments (e.g. government securities). Investments, however, will be controlled by the account bank and will themselves form part of the overall security package. An example of the type of investments that would be permitted is set out in Fig. 18. | ||

| + | |||

| + | One of the key features of these account provisions will be the establishment of a strict order of application (or payments waterfall as it is often referred to) so that when the account bank receives payments it knows how to apply them and in which order of priority. Therefore, if there are insufficient funds in the project accounts on any particular day, the account bank will know which payments it needs to make first. As one might expect, payment of the project company’s operating costs will come fairly near the top of the payments waterfall whereas payment of dividends and other distributions to shareholders will come fairly near the bottom of the payments waterfall. There can often be considerable debate between different classes of lenders as to the correct order of application amongst their respective loans. The usual approach is that all interest is paid before principal and then all principal is paid pro rata unless one group of lenders is expressly subordinated. An example of a payments waterfall is set out in table below. | ||

| + | {| class="wikitable" | ||

| + | |+ Type of investments that would be permitted is set out | ||

| + | |- | ||

| + | |'''18Authorised Investments''' | ||

| + | |'''Payments Waterfall''' | ||

| + | |- | ||

| + | | | ||

| + | *An investment shall be an Authorised Investment if: | ||

| + | ** It is a debt instrument | ||

| + | ** It has, at the time it is acquired by or on behalf of the Security Trustee or the Project Company, a remaining term to maturity of 180 days or less | ||

| + | ** It is either denominated in US Dollars or fully hedged against any exposure to currency exchange fluctuations against the US Dollar by a forward exchange contract on terms and subject to documentation approved by the Security Trustee | ||

| + | ** The relevant issuer, debtor or guarantor is either (i) a person whose long-term debt securities are for the time being rated [A+] or better by Standard & Poor’s Corporation or [A1] or better by Moody’s Investors’ Services, Inc. or (ii) the United States of America or any agency or instrumentality of it and | ||

| + | ** It is not a bearer instrument. | ||

| + | | | ||

| + | *First, to meet any sums then due to the Agent, the Account Bank, the Technical Bank or the Trustee (in each case in its capacity as such and pro rata) | ||

| + | * Second, in and towards transfers to the Operating Account in order to meet Operating Costs falling due in the next [ ] days• Third, in or towards payment of the costs, fees and expenses of the Financing Parties then due (to the extent not paid pursuant to “FIRST” above) | ||

| + | * Fourth, in or towards payment of interest then due• Fifth, in or towards payment of principal then due• Sixth, transfers total Debt Service Reserver Account of any sums required to at that time | ||

| + | * Seventh, transfers to the Maintenance Reserve Account of any sums required to be paid to that account at that time and | ||

| + | * Eighth, transfers to the Distribution/Dividends Account. | ||

| + | |} | ||

| + | |||

==Appointment of experts== | ==Appointment of experts== | ||

| + | One of the features of project financing is the extensive use of experts by the lenders. Whilst the lenders themselves (or at least some of them) will profess expertise in the structuring of the financing package for a project, there are many technical areas associated with the project where the lenders will need the resources of external consultants and other experts. For example, in an oil and gas project they will need to employ the services of external engineers who are able to advise them on the geology of the reservoir, the quantity, quality and recoverability of the reserves, when mechanical completion has occurred, etc. Another example would be traffic forecasting experts for a road or tunnel project. Although some lenders will employ internal engineers to help them with such matters, most banks do not have this resource and, in any event, will want the protection of external consultants. In all of these cases, the experts employed play a crucial role in advising the lenders since in most cases it is the data that they provide as forecasts that is fed into the banking cases for the project. Other experts regularly employed in projects are environmental and insurance experts who will be retained to provide reports and advice to the lenders on these aspects of the project. | ||

| + | |||

==Information and access== | ==Information and access== | ||

| + | The supply of reliable and accurate information in connection with a project is of crucial importance for the lenders and their advisers. Likewise, access to the project and its facilities will also be important for the lenders to be able to check regularly on progress and to monitor compliance with the terms of the documentation. The project loan agreement will contain detailed provisions on the type of information required and the frequency of delivery. The following are examples of the type of information usually required by lenders: | ||

| + | * Annual accounts and financial statements | ||

| + | * Periodic (e.g. monthly) progress reports during project construction | ||

| + | * Architect’s certificates etc., accompanying drawdown requests together with supporting invoices | ||

| + | * Copies of material notices and communications received under all project agreements | ||

| + | * Copies of communications from relevant authorities | ||

| + | * Details of all disputes and claims in connection with the project | ||

| + | * Periodic reports from experts | ||

| + | * Copies of all insurance documentation and claims | ||

| + | * Copies of all consents and permits relating to the project and | ||

| + | * Certificate of compliance with cover ratios etc. | ||

| + | |||

| + | There is often a danger that the project company becomes overwhelmed with the information requirements from the lenders and that the lenders themselves get bombarded with excessive information, a lot of which they don’t really need. There is a balance to be struck here and the parties need to take a sensible approach. | ||

| + | |||

| + | As noted above the lenders will want access to the project and the project facilities. They will also want their experts and consultants to be able to visit the project site from time to time in connection with preparation of their reports. This should not be objectionable to the project company provided it receives appropriate notice and the experts comply with safety requirements and other reasonable stipulations imposed by the project company in relation to site visits. Confidentiality will usually be an issue and the experts will usually be requested by the project company to sign a confidentiality undertaking. | ||

| + | |||

==Cover ratios== | ==Cover ratios== | ||

| + | One of the key features of project finance loan documentation is the use of cover ratios. Just as bankers in unsecured lending will use financial ratios to measure the financial health or well-being of a borrower from time to time, so will the project lender’s use cover ratios to assist it in evaluating the performance of the project both in the short term and over the life of the project. | ||

| + | |||

| + | There are two main cover ratios used by project lenders: | ||

| + | * Annual Debt Service Cover Ratio: this tests the ability of a project’s cash flow to cover debt service in a particular year | ||

| + | * Loan Life Cover Ratio and Project Life Cover Ratio: these ratios test the ability of a project’s cash flow over, respectively, the loan life and the project life to repay the loan. | ||

| + | |||

| + | Cover ratios such as these will be used for a variety of different purposes in the loan documentation. For example, it is likely that it will be a condition precedent to each drawdown that each of the agreed cover ratios will remain satisfied following such drawdown. If a cover ratio is not so satisfied, then the drawdown will not be permitted (although sometimes a partial drawdown may be permitted). The cover ratios may also be used as a tool in the pricing of the loan. Thus, if the project is performing above expectations then the borrower might reasonably expect to pay a lower interest margin on the loan to reflect the fact that the lenders are assuming a lesser risk. Conversely, if the project is performing less well then the lenders will expect a higher margin to reflect the increased risks they face. Another use of the cover ratios will be in the events of default where the lenders will set cover ratios, at a slightly lower level, which will trigger an event of default if they are breached. The levels at which the default cover ratios are set will obviously reflect a position where the lenders have real concerns about the ability of the project to generate sufficient cash flows to adequately service principal and interest over the life of the loan. Other uses of the cover ratios might be in fixing minimum amounts of repayment instalments and in controlling the payment of dividends or other distributions to the shareholders. | ||

| + | |||

| + | The method of calculation of cover ratios is broadly the same from one project to another. The lender will construct a computer program (or model) into which they will input all the projected costs that will be incurred by the project together with the project’s forecast receipts. The lender’s will have to make certain assumptions as to future variables such as interest rates, inflation rates, foreign exchange rates and (unless a fixed price is agreed for products) product prices. The model will, therefore, contain all of the relevant financial information necessary for calculating the cover ratios as well as other information concerning the project. The starting point for the lenders will be a “base case” model which will reflect the lenders’ opening evaluation of the project at financial close. The base case will have been agreed with the borrower and its advisers and should show the cover ratios being satisfied throughout the life of the project. However, since in constructing the base case, the lenders will have made a number of assumptions, it is axiomatic that the underlying fundamentals of the project as well as other matters such as interest rates, exchange rates, inflation rates, etc., will change over the life of a project. The lenders will, therefore, in addition to the base case construct a variety of other cases (or sensitivities) to test the robustness of the project economics in various other situations. These might include the following sensitivity cases: | ||

| + | |||

| + | * Changes in interest rates/exchange rates | ||

| + | * Changes in operating costs (including, where appropriate, fuel supply costs) | ||

| + | * Changes in income levels | ||

| + | * Occurrence of cost overruns | ||

| + | * Delay in completion or start-up | ||

| + | * Changes in taxation rates. | ||

| + | |||

| + | In running these sensitivities, the lenders will be looking to see in which circumstances the cover ratios will not be met and how the lenders can cover this risk. Ultimately, it may mean that the ratio of debt to equity in the project or some other aspect of the project’s economics has to be adjusted in order to ensure that the cover ratios are satisfied or that some other security or support from a shareholder or other third party is obtained by the lenders. | ||

| + | |||

| + | It will be apparent that the assumptions used in these banking cases (as they are commonly referred to) are of considerable importance. For example, in an energy project, an energy company may take a very different view as to likely oil, gas or electricity prices and interest and exchange rates over a 10-year period from a lender. Indeed, even between different lenders there will be different views on such matters. Not surprisingly, lenders tend to take a more conservative approach to forecasting. However, if they are too conservative then this can make some projects unbankable. There is often, therefore, during negotiations on project loan documentation considerable scope for discussion on how these assumptions are calculated and by whom. There is no hard and fast rule or right or wrong approach to this. Typically, however, a distinction will be made between financial assumptions (such as interest rates, exchange rates, discount rates, inflation) and technical assumptions (operating costs, capital costs, taxes, etc.). It is likely that the lenders will want to fix the financial assumptions on the basis that these lie within their field of expertise. On the other hand, the banks may well concede that the technical assumptions should be matters that the borrower should be in a good position to estimate. However, it is unlikely that the borrower will be allowed a completely free hand with all technical assumptions and the lenders will want to see these agreed with their own engineers. Sometimes, if no agreement on the technical assumptions can be reached, then the banks will agree to submit the matter to an agreed third-party expert who will decide the matter on behalf of the lenders and the borrower. It is less likely that the banks would agree to the appointment of an expert to determine the financial assumptions. As we have already seen they consider themselves experts on such matters in any event! From a borrower’s perspective, therefore, it will be looking to try to establish as objective a standard as possible for fixing the financial assumptions. | ||

| + | |||

| + | Having agreed the assumptions to be used in the banking cases, the calculation of the cover ratios becomes a simple arithmetical exercise. It is usually the case that a banking case will be run periodically (six monthly) throughout the life of the project as well as at given points in time such as on drawdown. | ||

| + | |||

| + | One of the key features in the calculation of the loan life cover ratio and the project life cover ratio is the use of discounting. Because both of these cover ratios project forward and make assumptions as to future costs, receipts, etc., in order to arrive at a present day value of these sums for the purposes of establishing the cover ratios at a particular time, it is necessary to discount these items. The usual method of discounting (or establishing the net present value of future cash flows) is to split the relevant period into, say, six-month periods (usually coinciding with interest periods/repayment periods) and to calculate the project costs/receipts for each of these periods, aggregate them and then net present value (discount) them at the agreed discount rate in order to calculate the net present value and internal rate of return. The discount rate is usually fixed by reference to current interest rates. Having established the net present value of the project’s cash flows this is then divided by the projected loan values remaining outstanding at the time the calculation is carried out. | ||

| + | |||

| + | Part of the methodology in using cover ratios will be to enable the lenders to give themselves sufficient comfort. Thus, for example, the lenders may take the view that a reasonable safety margin in a given project would be a project loan of two-thirds of the net present value of forecast project cash flows. This produces a cover ratio of 1.5 to 1 (being the inverse of two-thirds) which is not an untypical loan life cover ratio. Cover ratios can be as low as 1.3 to 1 in projects with particularly strong fundamentals, but it is rare to see a lesser figure as this affords the lenders very little margin for error. | ||

| + | |||

| + | The principal difference between the calculation of the loan life cover ratio and the project life cover ratio lies in the calculation of the project’s forecast receipts. No lender will construct a project loan on the basis that final repayment coincides with the end of a project’s useful life. Instead, the lenders will want to see that the loan is repaid some years before the end of the project’s useful life. Therefore, in calculating the loan life cover ratio the lenders are looking at forecast project receipts over the life of the loan only whereas with the project life cover ratio they are looking at the project’s forecast receipts over the life of the project itself. For example, in many oil and gas projects, the typical approach of lenders would be that they would not expect to lend against the field’s “reserve tail” (typically 25 per cent of the forecast reserves) since these are likely to be the most risky to extract in full and on time. In such a case, therefore, the lenders have constructed two important safety barriers. In the first place they will have fixed a cover ratio at a level that they feel comfortable with (in the above example 33 1/3 per cent) and in the second place they will only lend against, say, 75 per cent of project receipts. | ||

| + | |||

| + | The calculation of cover ratios is, therefore, a key feature of project loan documentation and one that requires considerable attention to detail in the loan documentation. It is one of the areas where it is essential for the legal advisers and the bankers to work especially closely. | ||

| + | |||

==Governing law and jurisdiction== | ==Governing law and jurisdiction== | ||

| + | |||

| + | The loan agreement for most internationally syndicated project financings will usually be governed by either the laws of England or New York. There are a number of reasons for this. Perhaps the most important reason is the feeling on the part of many banks that when lending internationally they prefer to see the laws of an independent country, such as England or the USA, apply to the lending documents. This is not to say that the lenders distrust other laws. It is simply a question of being more comfortable with the degree of independence offered by the laws of a third country. It is also undoubtedly the case that where they are dealing with complex international financings, lenders also are comfortable with the degree of knowledge and sophistication of the courts in England and the USA. Not surprisingly, lawyers in those two jurisdictions as a result have managed to establish themselves as leading experts in documenting and negotiating international project financings. This is not to say that lenders will not consider using other laws to regulate their loans. However, there will usually have to be some compelling reasons to persuade the lenders to accept other laws. | ||

| + | |||

| + | The position is slightly different with respect to security documents. As has been seen in section 6.9 the proper law of a security agreement will depend to a large extent on the nature of the security interest and/or the location of the asset in question being created. It is, therefore, not simply a question of the lenders selecting a law of their choice. It is far more a question of what is the appropriate way in which to take a security interest over a particular asset in a particular country. Thus, for example, there would be little point (and indeed it would be dangerous) in stipulating that English or New York law should apply to a mortgage over land in, say, Indonesia. In such a case, what is important is to ensure that the security interest over the land is valid and effective according to Indonesian law and that other laws will simply not be relevant. Similarly, if the lenders are looking at taking security over money in a bank account in France, then French law would be the proper law of the security and the security should be created in accordance with French law. | ||

| + | |||

| + | In most cases it will be obvious which is the proper law of the security interest but this will not always be the case and where there is doubt, the parties will normally look at all the surrounding circumstances and see which law has the closest connection with the asset over which security is being taken or, perhaps, where enforcement is most likely. If all else fails, one might then look at the law governing the loan agreement and apply the same governing law. The whole area of choice of law and conflicts of laws is a complex subject and outside of the scope of this Guide. | ||

| + | When it comes to governing law for project documents the position is less straightforward. In most jurisdictions the parties to a commercial agreement will be entitled to select the governing law to apply to that commercial agreement subject to certain ground rules (such as public policy and non-evasion of mandatory laws of a country). Not surprisingly, lenders on international project financings would prefer to see English or New York law governing all the key project documents. This, however, is seldom achieved. For example, insisting that a power purchase agreement between a project company and a local state electricity company be governed by a law other than appropriate domestic law is always going to be an uphill struggle. Likewise, most concession agreements between a governmental entity and the concession company are governed by the laws of the host country. The grey area comes where there is a contract, such as a fuel supply agreement or offtake agreement, that is entered into between parties in different countries and therefore there is no compelling governing law. In these cases the lenders are likely to be more successful in stipulating that an independent law such as English or New York law should apply. | ||

| + | |||